Advertisement|Remove ads.

Nvidia Eyes Shanghai R&D Center Amid US Export Pressure, Says Report: Retail Remains Buoyant

Nvidia Corp.(NVDA) is setting its sights on expanding research operations in China with a proposed research and development center in Shanghai.

According to a Financial Times report, the move aims to preserve its position in the region’s artificial intelligence landscape despite tightening U.S. trade restrictions.

The report cited that the tech behemoth’s CEO, Jensen Huang, discussed the initiative during a recent meeting with the Shanghai Mayor. It added that the firm is already leasing office space to accommodate current staff and prepare for possible growth.

U.S. President Donald Trump had imposed tariffs on China to encourage local production of technologies and hardware. The trade war has become a roadblock for Nvidia’s China business.

Nvidia’s hardware is pivotal in powering a wide range of AI applications, from conversational tools and image synthesis to technologies.

To make matters worse, the White House said the company would need a license to sell its H20 chips to China. Nvidia reacted, saying the ban could lead to a $5.5 billion hit to its quarterly revenue.

Also, the tariffs and chip export control have provided a perfect avenue for the Chinese tech giant Huawei Technologies to ramp up its AI offerings, giving it a competitive advantage.

China accounts for nearly 14% of Nvidia’s yearly income, roughly $17 billion, making it a key market the company sees as having major expansion potential. Estimates suggest it could grow to $50 billion.

As Nvidia balances compliance obligations and market demands, the challenge lies in balancing its business in one of its largest markets without infringing U.S. laws.

Responding to the Financial Times report, Nvidia stated it will not transfer GPU designs to China.

“We are not sending any GPU designs to China to be modified to comply with export controls,” a spokesperson told CNBC.

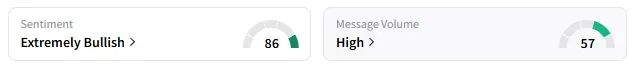

On Stocktwits, retail sentiment around Nvidia remained ‘extremely bullish’.

A Stocktwits user predicted the shares would cross $150 after the upcoming quarterly earnings on May 28.

Nvidia stock has gained 0.4% in 2025 and has jumped 42.8% in the past 12 months.

Also See: Quantum Computing Retail Investors Excited On Q1 Beat, Positive Management Commentary

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Editor's Note: This story has been updated with Nvidia's statement.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)