Advertisement|Remove ads.

Why Analysts See Nvidia’s Groq Licensing Deal As A Clear Win For AI Leadership

- Citi, Truist, and Stifel have maintained a “Buy” rating on the stock.

- Citi analyst Atif Malik viewed Nvidia's licensing deal with Groq as a "clear positive.”

- Truist said the reported $20 billion cost is high, but it is small relative to Nvidia's cash position and cash flow generation.

Nvidia’s stock was in focus on Monday after several top brokerages voiced their confidence in the chipmaker’s $20 billion licensing deal with AI chip startup Groq, saying that it could extend its leadership in the AI infrastructure space.

Analysts at Truist said that Nvidia's licensing agreement with Groq is intended to "fortify" its competitive positioning in inference versus tensor processing units, per TheFly. While the reported $20 billion cost is high, it is small relative to Nvidia's cash position and cash flow generation. The firm kept a “Buy” rating on the shares with a $275 price target.

Meanwhile, Citi analyst Atif Malik viewed Nvidia's licensing deal with Groq as a "clear positive.” Citi believes Nvidia has navigated regulatory scrutiny, given that Groq will remain an independent company. It kept a “Buy” rating with a $270 price target.

Stifel said that Nvidia's deal with Groq could extend AI infrastructure leadership and also kept a “Buy” rating on Nvidia with a $250 price target. UBS also remained bullish on Nvidia shares heading into 2026. It said that it expects appreciation from here to be driven almost by higher earnings estimates.

$20 Billion Groq Deal

Last week, Groq said that it had entered into a non-exclusive licensing agreement with Nvidia for its inference technology. While the company did not disclose a price, CNBC reported the deal could be valued at $20 billion.

As per the deal, Nvidia will onboard Groq’s senior management team, including founder Jonathan Ross and President Sunny Madra, to help advance and scale the licensed technology.

The deal comes at a time when Nvidia is facing stiff competition in the AI inference space from firms like Advanced Micro Devices and Broadcom, among others. Groq specializes in fast AI inference, which will give Nvidia more breathing room on the leaderboard, as it already dominates the market for training AI models.

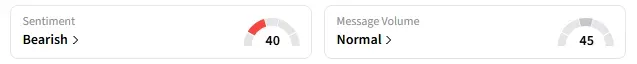

What Are Stocktwits Users Saying?

On Stocktwits, retail sentiment around NVDA stock trended in the ‘bearish’ territory amid “normal” message volume.

Shares of Nvidia have gained 36% so far in 2025.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)