Advertisement|Remove ads.

Nvidia Likely To See $12B Sales Risk As Broadcom’s Chip Demand Gains Steam, Says Citi

Nvidia Corp. (NVDA) received a slight reduction in its price target from Citi amid evolving dynamics in the artificial intelligence hardware market. Analyst Atif Malik believes Broadcom’s chip advancements could divert approximately $12 billion in prospective graphics processing unit (GPU) sales away from Nvidia.

The analyst revised the target price down to $200 from $210 while maintaining a ‘Buy’ rating on the stock, according to TheFly. Malik now forecasts a 4% decline in those sales due to potential competition from Broadcom’s (AVGO) next-generation XPU solutions.

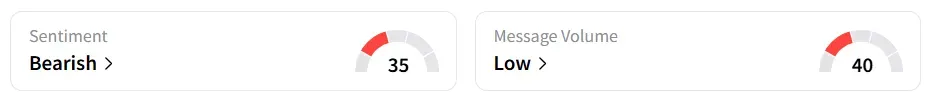

Nvidia stock inched 0.2% higher in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

A Stocktwits user noted that as the AI pie continues to grow, any drop in Nvidia’s AI dominance share appears insignificant.

Broadcom has recently emphasized rapid momentum in its artificial intelligence chip offerings. XPUs, which stand for Extended Processing Units, are custom chips designed for demanding data center workloads, such as AI and high-performance computing.

On the September 4 earnings call, Broadcom’s President and CEO Hock Tan said that one of the prospective customers it was working with in the third quarter (Q3) had placed production orders worth over $10 billion for AI racks based on its XPUs.

Nvidia has benefited significantly from AI-driven demand in recent years, and investors are closely monitoring how chipmakers evolve their product offerings to address the high-performance computing needs of AI developers.

Nvidia’s stock has gained over 24% year-to-date and over 56% in the last 12 months.

Also See: Beamr To Use Nvidia’s Tech To Bring Live Events Into 4K: Retail Excitement Surges

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228372233_jpg_0ab0e02ff6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)