Advertisement. Remove ads.

Nvidia Nears Record High While AMD, Broadcom, Qualcomm Slip – Citi Says ‘Almost Time to Buy’ But Retail Remains Skeptical

Nvidia Corp. ($NVDA) shares rose over 2% on Tuesday, recovering from a brief pullback in the prior session, after hitting a record high of $149.76 following its addition to the Dow on Friday.

However, other semiconductor stocks remain under pressure amid persistent concerns over slowing demand across the sector. Semiconductor estimates have dropped by 11% during the recent earnings season.

“We believe the downside/sell-off is almost over and attention will shift to 2025,” said Citi analyst Christopher Danely in a research note titled ‘Almost Time To Buy’.

According to him, the 9% decline in the Philadelphia Semiconductor Index ($SOX) was largely due to downside surprises from Microchip ($MCHP), NXP Semiconductors ($NXPI), and Intel ($INTC).

The brokerage projects global semiconductor sales will rise by 9% in 2025, building on 17% growth in 2024, as the industrial market stabilizes and the auto sector’s downturn eases in the first half of next year.

Nvidia Corp. ($NVDA)

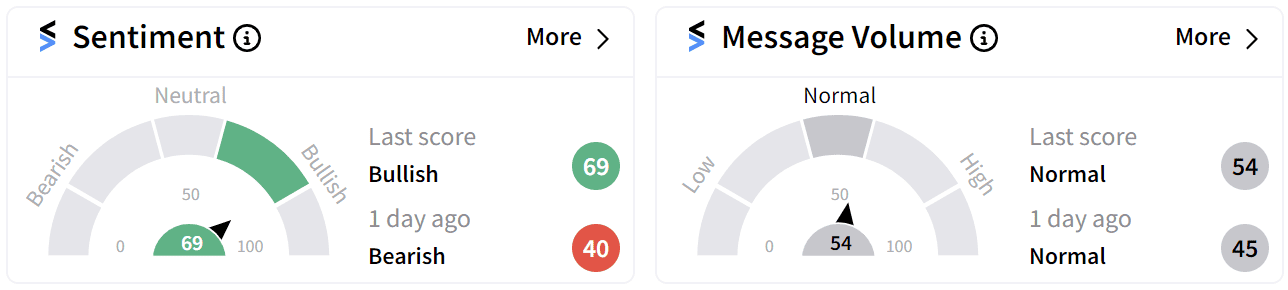

Shares of Nvidia’s were nearing a new record high after gaining 2% during mid-day trading on Monday. Retail sentiment on Stocktwits has flipped into the ‘bullish’ (69/100) territory from ‘bearish’ a day ago.

The semiconductor giant is set to announce third-quarter earnings after the close on Nov. 20, with Wall Street projecting earnings of $0.74 per share on $32.95 billion in revenue.

Nvidia, which recently replaced Intel ($INTC) in the Dow Industrial Average, has seen its stock soar by 206% this year, driven by strong AI and data center demand.

Broadcom Inc. ($AVGO)

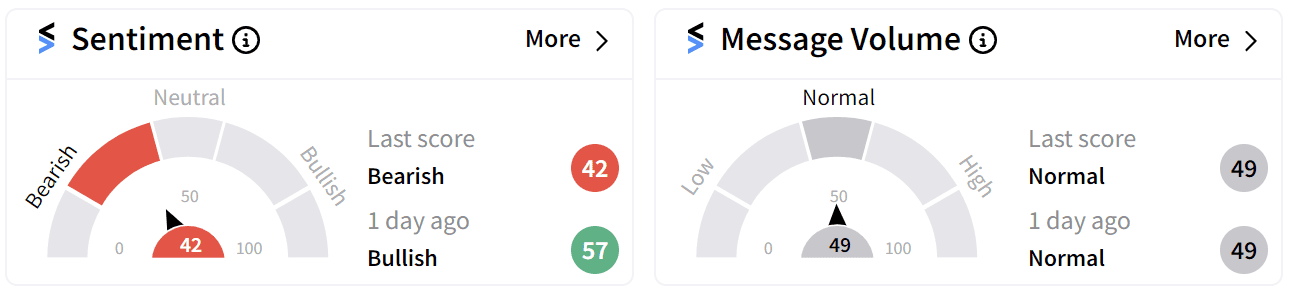

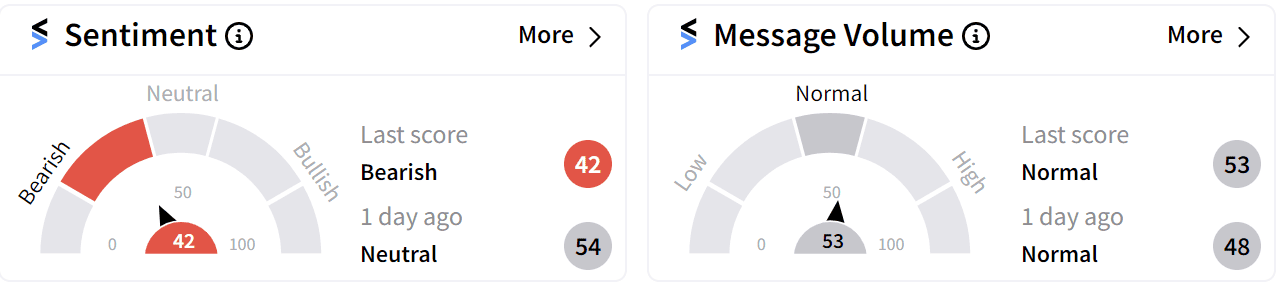

Shares of Broadcom were down nearly 2% during mid-day trading on Tuesday with retail sentiment flipping into the ‘bearish’ (42/100) territory from bullish a day ago on Stocktwits.

Analysts expect Broadcom to build on its recent growth, with 37 giving the stock buy-equivalent ratings and five recommending a ‘Hold’ rating.

Broadcom generated 47% revenue growth to $13.1 billion and an earnings increase of 18% to $1.24 per share in the third quarter.

Broadcom’s stock has gained 62% so far this year.

Advanced Micro Devices Inc. ($AMD)

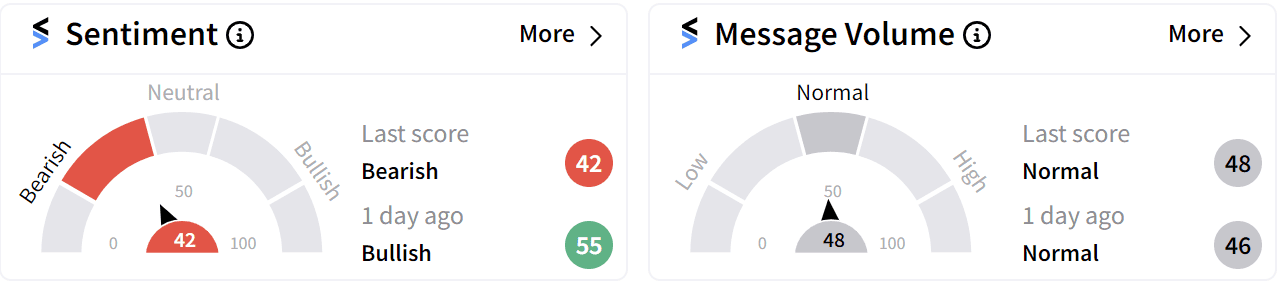

Shares of Advanced Micro Devices (AMD) were down over 3% on Tuesday as retail sentiment dipped to ‘bearish’ (42/100) from ‘bullish’ a day ago with consistent message volume on Stocktwits.

The chipmaker’s recent quarterly results met expectations, delivering earnings of $0.92 per share on $6.82 billion in revenue.

Wall Street remains favorable, with 37 analysts issuing buy-equivalent ratings and 11 suggesting a hold.

AMD stock has risen by 3% so far this year.

Qualcomm Inc. ($QCOM)

Shares of Qualcomm were also down over 3% on Tuesday as retail sentiment dipped to ‘bearish’ (42/100) territory with little change in message volume.

Some users on the platform voiced concerns that President-elect Donald Trump’s proposed policy changes could hamper the growth of the semiconductor industry.

Qualcomm’s stock has gained 16% so far in 2024.

Texas Instruments Inc. ($TXN)

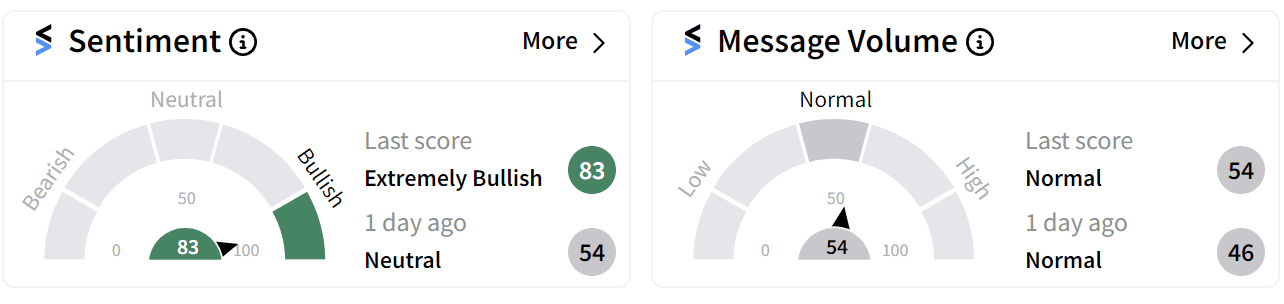

Shares of Texas Instruments were down nearly 3% on Tuesday but retail sentiment improved to ‘extremely bullish’ (83/100) from ‘neutral’ a day ago on Stocktwits.

Wall Street's outlook is mixed, with 18 analysts recommending a hold, 12 advising a buy, and 5 issuing sell-equivalent ratings.

The stock reached a record high of $220.39 on Friday and is up 24% year-to-date.

For updates and corrections email newsroom@stocktwits.com.

Read more: Camtek Shares Jump Premarket As HPC Demand Drives Earnings Beat: Retail's Overjoyed

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/img-20250906-wa0020-2025-09-5eb06bd17ff7f09275c65cf5224cebaf.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/03/cars-auto-sales-trade-2025-03-112a2d39607959bc768b9aab6126e355.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228106047_jpg_9b9a5ca202.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/anand-singha-thumnails-90-2025-02-69074ef2fa5040cebb8fe5d51a8f98e4.jpg)