Advertisement|Remove ads.

Nvidia Shares Hit All-Time High On AI Optimism: Retail Calls It ‘Infrastructure Of The AI Revolution’

Shares of Nvidia Corp. (NVDA) jumped to a record high of over $186 on Tuesday as momentum around demand for artificial intelligence infrastructure continued to gather pace.

The chip giant also received a boost from two major Wall Street firms, with both KeyBanc and Citi raising their price targets based on improving supply dynamics, product advancements, and AI demand.

KeyBanc lifted its target price on Nvidia shares to $250 from $230, maintaining an ‘Overweight’ rating, according to TheFly. The firm pointed to improved CoWoS (Chip-on-Wafer-on-Substrate) availability through 2025-2026 and better-than-expected rack production yields, which are projected to support approximately 30,000 GB (Gigabyte) racks in 2025 and at least 50,000 in 2026.

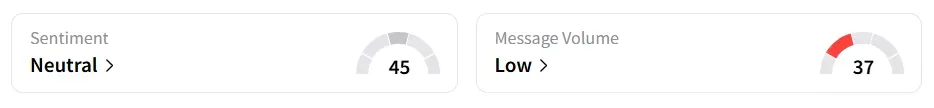

On Stocktwits, retail sentiment around Nvidia stock remained in ‘neutral’ territory amid ‘low’ message volume levels.

The stock saw a 306% increase in user message count over 24 hours, as of Tuesday morning. A bullish Stocktwits user called the company ‘infrastructure of the AI revolution’.

KeyBanc said enhanced specifications for the upcoming VR200 NVL144 system also reinforce Nvidia’s lead over rival Advanced Micro Devices Inc. (AMD).

Citi also revised its price target on the stock, increasing it to $210 from $200 while keeping a ‘Buy’ rating. Following meetings with Nvidia's management, the firm stated that it is “incrementally positive” about the company’s product momentum and positioning following the Rubin CPX chip launch.

Citi highlighted the upcoming GTC Washington event, scheduled for October 27–29, as a potential catalyst for further gains, especially amid rising forecasts for AI infrastructure investment.

Nvidia stock has gained over 39% year-to-date and over 54% in the last 12 months.

Also See: American Battery Technology Partners With Call2Recycle To Expand US Battery Recycling

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)