Advertisement|Remove ads.

Nvidia Draws Investor Attention On Report Of Chinese Buyers Bypassing US Chip Curbs – Stock Slides But Retail’s Unswayed

Nvidia Corp. (NVDA) shares fell more than 5% at the market open on Monday following a Wall Street Journal report alleging that Chinese buyers are securing the company’s chips despite U.S. export restrictions.

The report detailed how traders in China are sourcing computing systems equipped with Nvidia’s Blackwell chips through third parties in neighboring regions.

Some resellers are even promising delivery within six weeks, circumventing measures the U.S. government has enforced to restrict China’s access to advanced semiconductors for AI training and computing since 2022.

To sidestep these controls, Chinese resellers are using entities registered outside of China to purchase Nvidia-powered servers from firms in Malaysia, Vietnam, and Taiwan.

These firms, which include data-center operators and authorized Nvidia partners, reportedly acquire the systems for their own operations but then resell a portion to buyers in China.

Although Blackwell chips represent Nvidia’s latest and most advanced AI chips, most models from its older Hopper family also remain subject to U.S. export restrictions. According to traders, the H200 chip within the Hopper lineup accounts for the bulk of Chinese orders.

Washington has been trying to impose export controls since 2022 to curb China’s access to semiconductors for training and powering state-of-the-art AI. However, the report suggests that an underground network of brokers has sprung up to circumvent the controls.

Nvidia told WSJ it would investigate any reports of unauthorized resales and take appropriate action.

The company emphasized that buyers of advanced AI hardware typically require services and support, “none of which anonymous traders claiming to possess Blackwell systems can provide.”

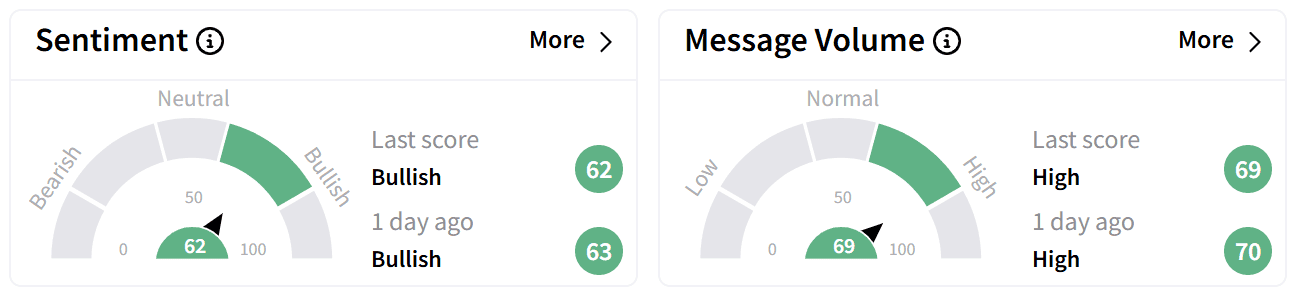

Despite the report, retail sentiment on Stocktwits remained in the ‘bullish’ zone accompanied by ‘high’ levels of chatter.

Some traders expressed frustration that Nvidia was among the few stocks trading lower while broader markets posted gains pre-market.

Others speculated that market makers were manipulating the stock’s price.

Meanwhile, demand is also growing for Nvidia’s H20, the most powerful AI processor among those still allowed under current U.S. export controls.

Industry sources told WSJ that major Chinese cloud providers such as Alibaba, Tencent, and ByteDance have been stockpiling H20 chips, anticipating that a potential second Trump administration could extend restrictions to cover them.

Nvidia shares have declined more than 11% in 2025 but remain up around 43% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)