Advertisement|Remove ads.

Nvidia Gains Aftermarket As Analysts Hike Targets After Blowout Q4 On Surging Demand: Retail Ramps Up Long Bets

Shares of Nvidia Corp. (NVDA) edged up by 0.8% in after-market trade on Thursday after a slew of price target hikes from brokerages following the company’s blowout fourth-quarter results.

However, during Thursday’s regular trade, Nvidia stock plunged by over 8% even as the AI bellwether beat Wall Street estimates to report 78% year-on-year (YoY) revenue growth and earnings per share (EPS) of $0.89, ahead of an estimated $0.85.

Notwithstanding the Thursday plunge, Nvidia’s stock received several price target hikes, with brokerages like JPMorgan, Bernstein, Morgan Stanley, and Bank of America (BofA) Securities, among others, weighing in on the company’s Q4 performance.

According to The Fly, analysts at BofA sounded optimistic about Nvidia’s Blackwell chip sales ramp, noting that at $11 billion, the AI giant’s flagship offering was in far higher demand than estimates of $4 billion to $ 7 billion.

The brokerage noted this implies that Nvidia has overcome Blackwell concerns, which augurs well for the coming quarters, and that it remains in the “dominant position of leading the AI market.”

BofA hiked its price target to $200 from $190 while maintaining a ‘Buy’ rating. This implies an upside of 40% from Thursday’s closing price.

JPMorgan analysts underscored that demand for Nvidia’s graphics processing units (GPU) continues to outstrip supply, noting that the Jensen Huang-led company is “further distancing” itself from competition thanks to an “aggressive” cadence of new products.

The brokerage has an ‘Outperform’ rating with a price target of $170.

Looking ahead, Nvidia guided for Q1 revenue of $43 billion, plus or minus 2%. This is higher than consensus estimates of $42.05 billion. Analysts at Bernstein and UBS observed that Nvidia is past the Blackwell issues, and production is progressing at full speed.

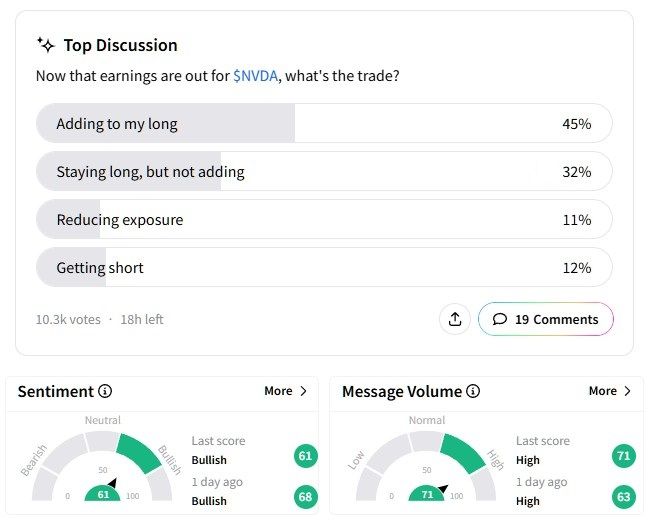

Retail sentiment on Stocktwits remained in the ‘bullish’ (61/100) territory while message volumes continued to rise.

In a Stocktwits poll with over 10,300 votes, users expressed a largely bullish outlook – 45% of the respondents said they are adding more long positions, while 32% said they will stay long.

Only 11% of the users said they were reducing their exposure to the stock, while 12% said they would short it.

Pondering over the 8% drop in Nvidia’s stock despite a strong Q4, one user presented an alternative scenario where the company missed estimates.

Nvidia’s stock has had a rough ride this year, falling over 13%. It has also been in the red over the past six months, with a decline of over 6%.

In contrast, Nvidia’s shares have risen nearly 53% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Cisco Stock Gets A Price Target Hike At Citi On Nvidia's Strong Q4: Retail Stays Extremely Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)