Advertisement|Remove ads.

Nvidia Stock Eyes World’s Most Valuable Crown Once Again: Retail Bulls Charge Ahead

Nvidia Corp’s (NVDA) shares are on track to hit a record high on Monday, rising 3.2% to $193.02 by mid-morning.

The stock is set to surpass its previous all-time high of $135.58 set on June 18 after Nvidia’s 10-for-1 stock split. With a gain of just $6.24 from Friday’s close, Nvidia could once again dethrone Apple (AAPL) as the world’s most valuable company.

As of Friday, Nvidia’s market cap stood at $3.31 trillion, just $150 billion behind Apple’s $3.46 trillion. The chipmaker is emerging as a formidable contender for the top spot in global market value.

The jump in Nvidia’s share price comes after TD Cowen reiterated its confidence in the stock, maintaining a ‘Buy’ rating and a price target of $165. The brokerage expects strong demand for Nvidia’s Hopper products to help cover any potential slowdowns as the product is introduced into the market. The analyst’s research note highlighted that Nvidia’s spending on AI is likely to grow.

Separately, a government-backed think tank has recommended that data centers in mainland China opt for Nvidia chips over domestic alternatives. According to a report from South China Morning Post, Nvidia's chips are highly sought after by major companies and organizations in the region.

However, Nvidia faces increasing pressure at home to restrict shipments of its advanced GPUs to China due to concerns that the technology may bolster the Chinese military.

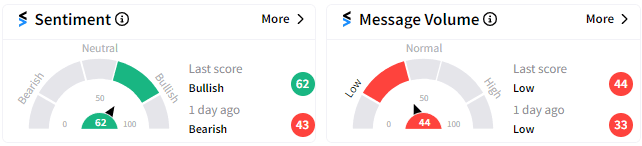

Retail sentiment on Stocktwits has flipped into ‘bullish’ territory (62/100) from ‘bearish’ a day ago.

Some users on the platform are expecting the stock to hit a new record today.

Nvidia's stock has seen a sharp rise throughout October, with a six-day winning streak following the announcement of a $6.6 billion funding round for ChatGPT-maker OpenAI. Much of that funding is expected to flow back to Nvidia, as OpenAI’s growing computing needs will drive demand for more AI chips.

Despite a brief stumble in share price after Advanced Micro Devices Inc (AMD) launched its competing AI chip, Wall Street analysts reaffirmed their bullish stance on Nvidia. KeyBanc projects that Nvidia will rake in $7 billion in revenue from its upcoming Blackwell chips alone, with robust demand continuing for its older GPUs.

Nvidia is scheduled to report earnings on Nov. 20, having exceeded EPS estimates for the last four consecutive quarters. For the upcoming third-quarter results, Wall Street anticipates earnings per share (EPS) of $0.74, according to data from Stocktwits.

For updates and corrections email newsroom@stocktwits.com.

Read more: AMD’s Stock Jumps After Taking Aim at NVIDIA: Wall Street and Retail Investors Join The Cheer

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217223717_jpg_e05dddbc9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sea_ltd_jpg_b4cc09a88d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219834417_jpg_a7705b50b5.webp)