Advertisement|Remove ads.

Nvidia Stock Plunges After-Hours On Disclosing $5.5B Charge Linked To New China Export Curbs: Retail Watches Cautiously

Shares of artificial intelligence (AI) frontrunner Nvidia Corp. (NVDA) fell sharply in Tuesday’s after-hours session after disclosing charges related to China chip exports.

In an 8K filing with the SEC, Nvidia said its first-quarter results will include up to $5.5 billion in charges associated with H20 AI accelerator exports to China, including Hong Kong, Macau, and D5 countries.

D5 countries are a group of nations subject to the U.S. arms embargoes and other export restrictions under the Export Administration Regulations.

The licensing requirement also applies to companies headquartered or with an ultimate parent in these countries and to any other chips achieving H20’s memory bandwidth, interconnect bandwidth, or both.

Nvidia said it was notified by the government regarding the same on April 9. Later on Monday, the government communicated that the license requirement would be in effect indefinitely.

With the new licensing requirement, the government intends to address the risk that the covered products may be used in or diverted to a supercomputer in China, Nvidia said in the filing.

The Jensen Huang-led company developed the H20 chips to circumvent the export licensing requirements for advanced high-performance processors established by the previous administration under President Joe Biden.

The H20 chips are comparable to Nvidia’s H100 and H200 AI chips, although they have slower interconnection speeds and bandwidth and are built on Hopper architecture. The company has since started selling the next-gen Blackwell chips.

According to the fourth-quarter earnings call transcripts accessed via Koyfin, as a percentage of total data center revenue, Nvidia’s data center sales in China remained well below levels seen at the onset of export controls.

Huang had said, “Absent any change in regulations, we believe that China shipments will remain roughly at the current percentage,” adding that he expects the Chinese market to remain highly competitive.

The 10-K report for the fiscal year 2025 showed that Nvidia derived roughly 6% of its revenue from China. However, the country was the company’s fourth largest revenue-earning geography after the U.S., Singapore, and Taiwan.

The development comes even as the specter of massive tariff levies remains an overhang amid confounding signals from Washington.

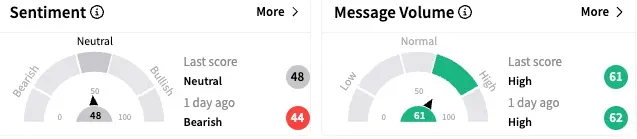

On Stocktwits, retail sentiment toward Nvidia stock was ‘neutral’ by late Tuesday, although improving from ‘bearish’ a day ago. The message volume stayed ‘normal.’

A bearish watcher said Nvidia stock could drop to $90 on Wednesday amid the tariff and the latest disclosure.

The stock settled Tuesday’s session up 1.35% to $112.20 following President Donald Trump pledging fast-track permits for Nvidia’s $500 billion domestic AI investment.

However, a bullish user expected Wall Street to go about bargain hunting, positioning the stock for a short squeeze on Thursday.

In the after-hours session, Nvidia stock fell 6.31% to $105.12, taking its year-to-date losses to over 16%. The stock trades way off its all-time high of $153.13 hit on Jan. 7.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)