Advertisement|Remove ads.

Nvidia’s Streak of Record-Breaking Quarters Drives Retail To Buy More And Stay Long

After yet another record quarter, retail traders aren’t just holding their Nvidia positions— the majority are buying more, banking on AI demand to keep Nvidia’s meteoric rise intact.

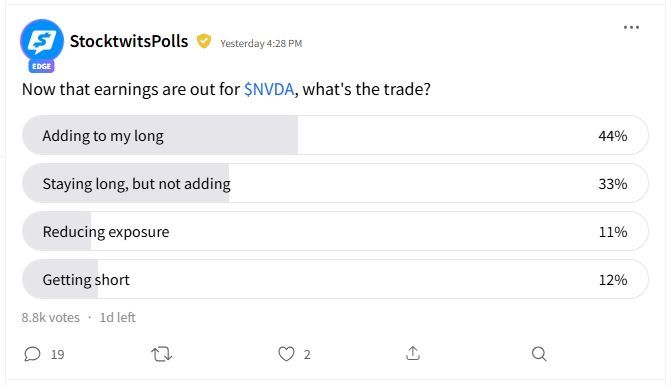

In a post-earnings Stocktwits poll, 44% of respondents said they would add to their long positions, while another 33% would stay long but prefer not to add more.

The enthusiasm follows another record-breaking quarter for Nvidia.

The chipmaker reported fourth-quarter (Q4) revenue of $39.3 billion, up 78% year over year, with data center sales driving much of the growth.

Full-year revenue topped $130 billion, more than doubling from the prior year.

Management credited the surge to Nvidia’s dominance in AI chips, particularly with its new Blackwell AI supercomputers, which continue to cement its leadership in the space.

The company’s first-quarter revenue guidance stood at $43 billion.

During the Q4 earnings call, CEO Jensen said, “AI is advancing at light speed,” with Nvidia at the center of the transformation.

Still, not everyone is convinced. While only 12% of poll respondents indicated they were shorting the stock, concerns over valuation and competition persist.

According to TheFly, Summit Insights downgraded Nvidia to ‘Hold’ from ‘Buy,’ citing risks related to its rapid growth and potential market shifts.

The brokerage acknowledged Nvidia’s continued outperformance but warned that supply is beginning to catch up with demand, which could slow growth in the second half of the fiscal year 2026.

Summit also noted that lower computing power requirements for AI inference – though not yet evident – could impact Nvidia’s financial performance over the medium to long term.

Meanwhile, after the earnings report, JPMorgan and Citi kept their ratings and price targets unchanged.

Other firms, including Citi, Morgan Stanley, and Bank of America, raised their price targets while maintaining their bullish outlook on Nvidia.

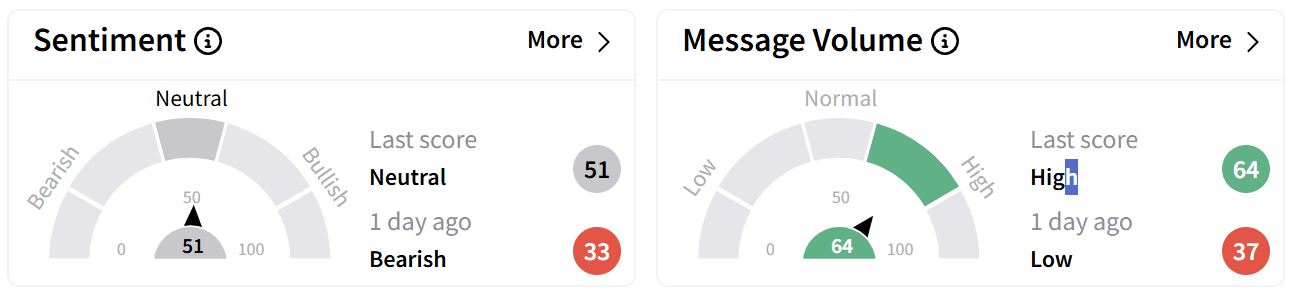

On Stocktwits, retail sentiment around Nvidia’s stock improved to ‘neutral’ from ‘bearish’ territory, with an uptick in chatter to ‘high’ levels.

While some traders anticipate further gains when markets open Thursday, others remain cautious, pointing to GDP data set for release later in the day as a potential catalyst.

Nvidia’s stock has gained 5% over the past month and is up 64% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: STMicro Stock Slides As Italy Reportedly Pushes for CEO’s Exit: Retail Traders Turn Cautious

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)