Advertisement|Remove ads.

STMicro Stock Slides As Italy Reportedly Pushes for CEO’s Exit: Retail Traders Turn Cautious

NYSE-listed STMicroelectronics NV (STM) shares slipped over 2% in morning trade on Wednesday after Bloomberg reported that the Italian government is seeking to replace CEO Jean-Marc Chery due to what officials describe as "insufficient" performance.

Citing unnamed sources, Bloomberg said Italian officials believe Chery has failed to navigate the company through mounting industry challenges.

The discussions add pressure at a critical time for STMicro, whose shares have significantly underperformed semiconductor peers in recent years.

STMicro’s stock has declined more than 40% over the past year, in sharp contrast to peers Broadcom (AVGO) and Texas Instruments (TXN), which have gained 60% and nearly 20%, respectively.

The Philadelphia Semiconductor Index managed a modest 1.5% gain over the same period.

Italy and France, which jointly hold a 27.8% stake in STMicro through their respective governments, view the company as a strategic asset.

While Italian officials are pushing for a leadership change, they recognize they may lack the authority to unilaterally replace Chery, Bloomberg reported. The decision is expected to be a point of negotiation between Rome and Paris.

Chery was re-elected for a three-year term in May 2023, adding complexity to any potential leadership transition.

Neither the Italian Treasury nor STMicroelectronics has commented on the matter.

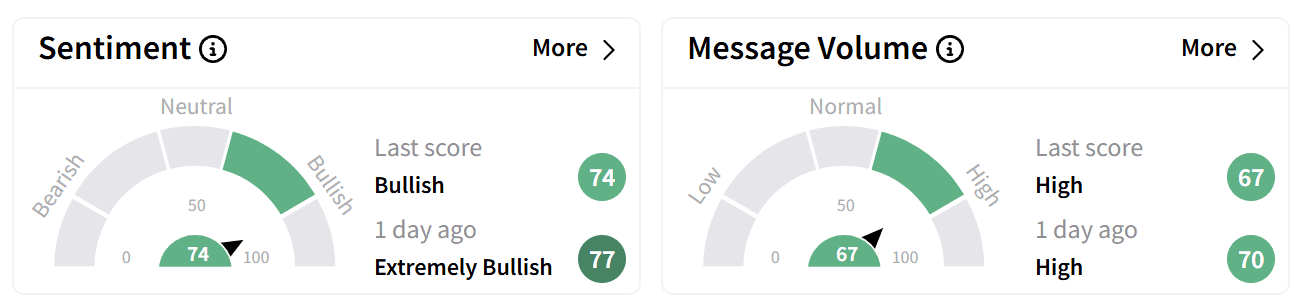

On Stocktwits, retail sentiment around STM’s stock shifted from ‘extremely bullish’ to ‘bullish’ following the news, with increased chatter among investors.

One user compared STMicro's situation to Intel Corp. (INTC), cautioning that adverse developments are piling up for the company.

STMicro, which supplies chips to major clients such as Apple Inc. and Tesla Inc., has struggled amid declining demand for automotive and industrial semiconductors.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)