Advertisement|Remove ads.

Nvidia Stock Hits Six-Month Low Amid Market Slump – Analyst Slashes Price Target, Eyes Jensen Huang’s Keynote At GTC 2025

Nvidia (NVDA) shares fell as much as 5% in midday trading on Monday to hit a six-month low amid the broader market slump triggered by fears of a recession in the world’s largest economy.

However, the stock drew investor attention as Melius Research lowered its price target, citing that multiple factors have clouded the stock’s near-term outlook.

The stock touched an intraday low of $106.18, marking a six-month low. Melius cut its price target to $170 from $195 but maintained its ‘Buy’ rating.

Nvidia and other artificial intelligence-related stocks have been under pressure due to a mix of regulatory risks, potential tariffs, and technological advancements that could lower computing costs, Melius Research analyst Ben Reitzes wrote in a note cited by Barron’s.

“As a result, AI semiconductor and hardware stocks are trading like no one knows what’s going on – including shares of Nvidia,” he said.

The next key event for Nvidia investors will be the company’s GTC conference next week in San Jose, California.

CEO Jensen Huang will deliver a keynote speech on March 18, during which analysts expect him to highlight AI’s continued potential.

Reitzes noted that Huang could use the platform to reassure investors, pointing to AI-driven advancements such as software replacing expensive seat-based software as a service (SaaS), the rise of autonomous vehicles, workforce-augmenting robots, and AI breakthroughs in healthcare.

Nvidia is also expected to unveil details about its upcoming Blackwell Ultra graphics processing unit (GPU) and GB300 system, which is slated for release later this year.

The company may also offer a glimpse of its Rubin GPU and Arm-based central processing unit (CPU) called Vera, both scheduled for 2026.

“At this point, we believe Nvidia and several others in the AI semiconductor and hardware space are on sale and good buys right now,” Reitzes wrote. “That doesn’t mean the stocks will perform well in the near term, given the lack of clarity on regulations, geopolitics, and tariffs.”

Investor sentiment was further weighed down by political uncertainty.

Over the weekend, President Donald Trump declined to rule out a recession this year, adding to broader market unease.

These concerns have overshadowed the strong AI demand signaled by Taiwan Semiconductor Manufacturing Co.’s (TSMC) (TSM) latest results. Nvidia’s chip supplier reported Monday that its February sales jumped 43% year-over-year.

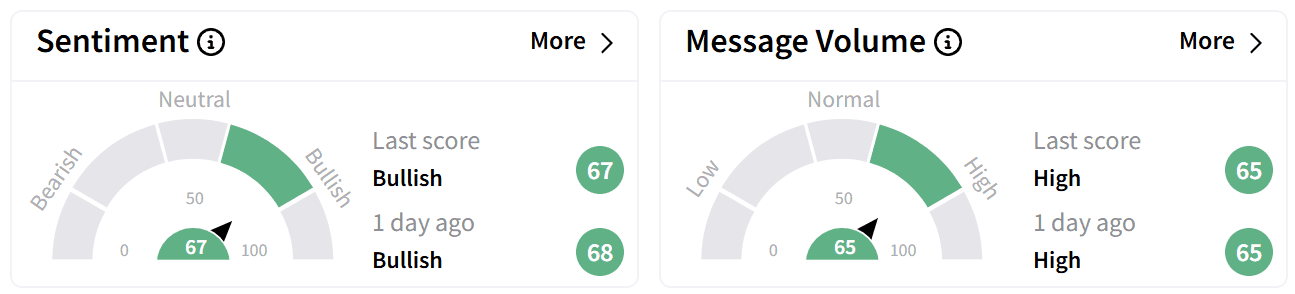

On Stocktwits, retail sentiment around Nvidia’s stock remained in the ‘bullish’ zone, accompanied by ‘high’ levels of chatter.

One user commented that despite the volatility, they are holding on to the AI bellwether’s shares for the long term.

Another suggested the stock could use a “dead cat bounce,” referring to a temporary recovery in a declining market that does not signal a lasting reversal.

Nvidia shares are up 25% over the past year but have fallen more than 20% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)