Advertisement|Remove ads.

Strategy Stock Slides More Than 10% Amid Plans Of $21B Share Sale To Buy More Bitcoin – Retail Stays Cautiously Optimistic

Strategy (MSTR) dropped as much as 11% on Monday morning after the company unveiled plans to raise up to $21 billion through an at-the-market (ATM) offering.

The Michael Saylor-led company, widely regarded as a Bitcoin proxy, said it would issue 8.00% Series A perpetual strike preferred stock (STRK), which can be converted into its Class A common shares.

The sale will be executed gradually based on market conditions, with proceeds earmarked for general corporate purposes, including further Bitcoin acquisitions and funding operations.

A new round of purchases would push Strategy’s Bitcoin holdings past the 500,000 mark, further solidifying its position as the largest corporate holder of the cryptocurrency.

Bitcoin initially edged higher following the announcement but later dipped to an intraday low of $79,367 as broader market sentiment soured, according to CoinGecko data.

China's newly imposed tariffs on U.S. agricultural products rattled investors. Adding to market pressure, President Donald Trump declined to rule out the possibility of a recession as he outlined his trade policy approach in a Fox News interview.

"I hate to predict things like that," Trump said, adding that the U.S. was in a "period of transition" due to his administration's sweeping economic changes.

On the stock market, he offered little reassurance, stating, "Look, what I have to do is build a strong country. You can't really watch the stock market. If you look at China, they have a 100-year perspective."

Strategy, formerly known as MicroStrategy, is the largest corporate holder of Bitcoin, with just shy of 500,000 tokens worth about $42 billion at Bitcoin's current price.

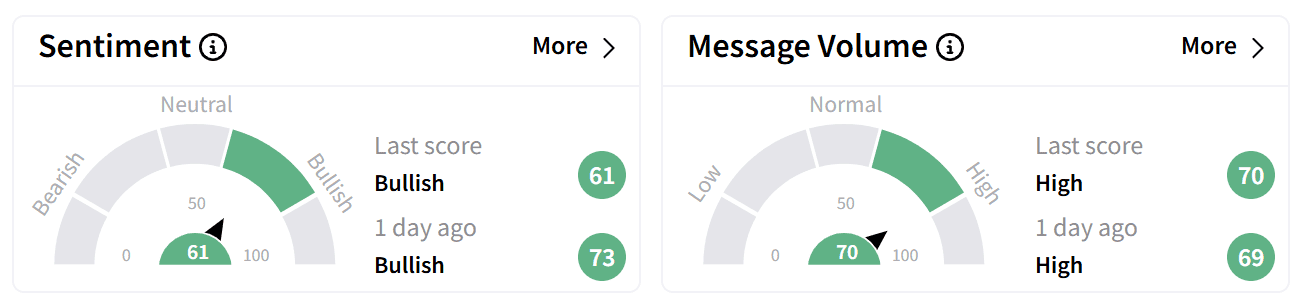

On Stocktwits, retail sentiment around Strategy’s stock inched lower but continued to trend in the ‘bullish’ territory. The move was accompanied by ‘high’ levels of chatter.

One user warned that issuing new shares to fund Bitcoin purchases at current levels is a "risky proposal."

While applauding the BTC play, another user said it would be a bumpy ride ahead.

Despite a 66% gain over the past year, Strategy’s stock is down 14% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)