Advertisement. Remove ads.

NYCB Stock Dips Premarket After Fourth Straight Quarterly Loss: Retail Is Unmoved

New York Community Bancorp, Inc. ($NYCB) shares fell over 3% in Friday’s pre-market session after the lender reported a fourth consecutive quarterly loss.

NYCB reported a 40% year-over-year (YoY) decline in its third quarter total revenue to $623 million, topping a Wall Street estimate of $616 million. The bank reported an adjusted earnings loss of $0.69 that came in wider than an estimated loss of $0.42.

Net interest income, the difference between interest earned and interest expended, fell 42% YoY to $510 million during the quarter. It fell 8% compared to the second quarter of 2024.

The bank attributed the decline in NII compared to second quarter of 2024 to lower average loan balances arising from the sale of the mortgage warehouse business, continued payoffs in both the multi-family and commercial real estate portfolios, and a decline in the commercial and industrial loan portfolio.

Net loss attributable to common stockholders stood at $289 million compared to a profit of $199 million in the same period a year ago. However, losses have narrowed compared to the last three quarters.

However, the most notable metric in the bank’s Q3 earnings report came in the form of provisions for credit losses that nearly quadrupled to $240 on a YoY basis.

CEO Joseph M. Otting said the bank has completed 97% of its annual review of the multi-family and commercial real estate portfolios and have taken substantial charge-offs across the portfolio.

“Our CRE exposure continues to decline through a combination of par payoffs and proactively managing problem loans. Total CRE loans declined 3% compared to the previous quarter and decreased 6% year-to-date,” he said.

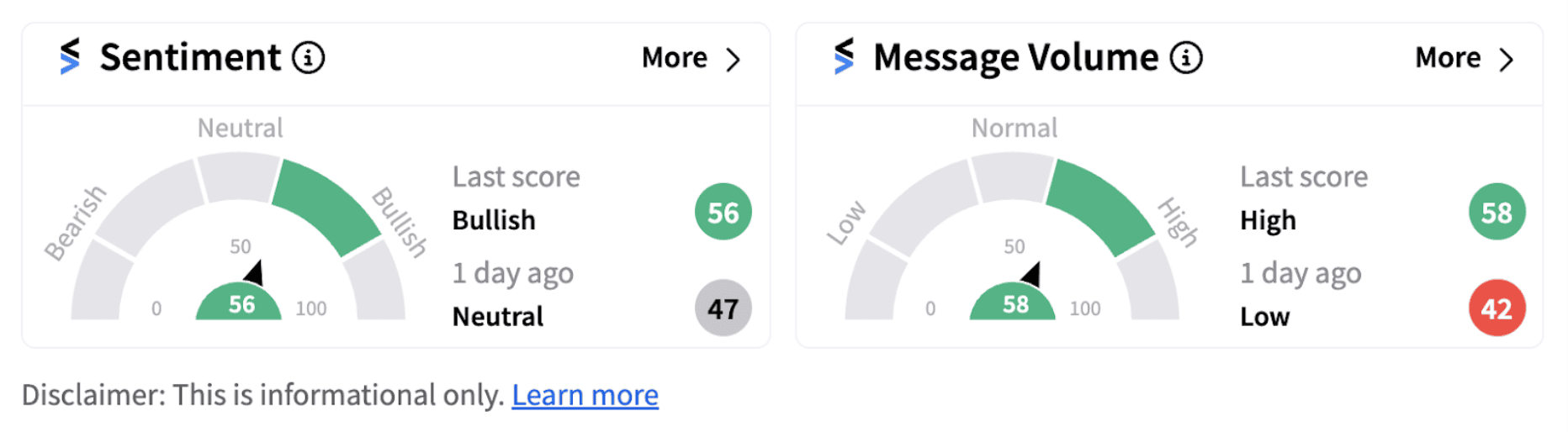

Following the earnings announcement, retail sentiment on Stocktwits inched up into the ‘bullish’ territory (56/100) from ‘neutral’ a day ago.

Shares of the lender have lost over 63% on a year-to-date basis.

Also See: Centene Corp Stock Jumps Pre-market As Q3 Results Top Estimates: Retail Goes ‘Extremely Bullish’

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/10/biogas.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/air-india-a350-900-2024-11-2a018689c22e8e313593c4b76845dbc8.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/swiggy-zomato-2024-11-abc7dc409c45ae64aa63306af7904262.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/shutterstock-2162617539-2025-08-b6396e634f55857935c2208abb72fdf6-scaled.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)