Advertisement|Remove ads.

Obsidian Energy Stock Gains After-Hours On Asset Sale To InPlay Oil: Retail Stays Bearish

Obsidian Energy (OBE) shares rose 7.3% in aftermarket trade on Wednesday after the company agreed to sell some of its assets to Calgary-based InPlay Oil Corp for C$320 million ($225 million).

The company said it would receive C$220 million in cash, C$85 million in equity, and InPlay’s 34.6% working interest in the Willesden Green Cardium Unit #2 oilfield valued at C$15 million.

After the deal closes, expected in the early second quarter, Obsidian’s interest in the Willesden Green oilfield will be about 99.8%.

The assets include 498 net sections of land in the Pembina area of Central Alberta, including associated facilities and gathering systems.

Obsidian said the sale would help lower its net operating costs by approximately $2.20 per barrel of oil equivalent (boe).

The company said that, as part of the deal, it has agreed to drill four wells on two pads in the Pembina area during the first quarter at InPlay’s expense.

Obsidian said the cash proceeds would help lower its pro forma year-end 2024 estimated net debt to about C$192 million from C$412 million.

“Pro forma, Obsidian Energy will have a production base of over 29,000 boe/d (based on estimated fourth quarter 2024 production) with Peace River now becoming our largest asset, where we will continue to execute on our growth plan,” CEO Stephen Loukas said.

The company is scheduled to report fourth-quarter results before the markets open on Feb. 25.

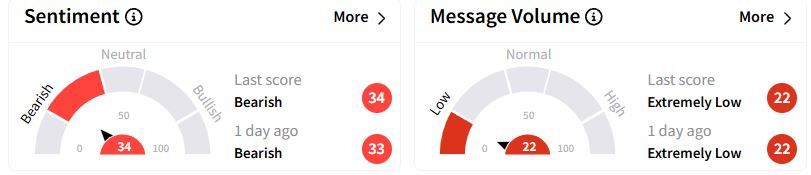

Retail sentiment on Stocktwits remained in the ‘bearish’ (34/100) territory, while retail chatter remained ‘extremely low.’

Over the past year, Obsidian's U.S. shares have gained 1.3%.

Also See: SM Energy Stock Gains After The Bell On Upbeat Q4 Revenue: Retail Sentiment Hits 1-Year High

1 Canadian dollar = $0.70

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)