Advertisement|Remove ads.

Oil Prices Edge Lower As Traders Remain Cautious After EU-US Trade Deal Ahead Of Fed Meet

Oil prices slipped marginally early on Tuesday as traders assessed the economic impact of the trade deal between the European Union and the U.S. ahead of the Federal Reserve’s key policy meeting.

The EU has agreed to a baseline tariff of 15% for its exports to the U.S., including automobiles. The 27-nation bloc also agreed to American energy products worth $750 billion and pledged to invest $600 billion in the U.S.

The deal alleviated some concerns about a slowdown in economic growth, as the EU is Washington's largest trading partner. However, it still poses risks to trade volumes as U.S. tariffs on EU products were around 1.2% last year.

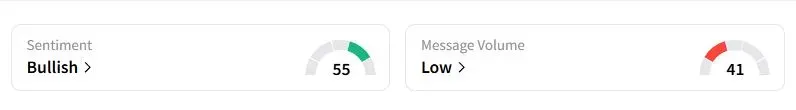

Benchmark Brent crude prices were down 10 cents at $69.94 per barrel, while U.S. West Texas Intermediate crude prices were down 0.1% at $66.66 per barrel at 4.07 a.m. ET. Retail sentiment on Stocktwits about the United States Oil Fund (USO) was in the ‘bullish’ territory, compared with ‘neutral’ a day ago.

"We don’t expect the increase in the tariff rate to directly drive EU rating changes on its own, but it could compound existing credit pressures," Fitch Ratings' analyst Ed Parker said to Reuters.

Separately, senior officials from China and the U.S. met in Stockholm, with the talks prolonging for more than five hours on Monday and set to continue on Tuesday. The two sides are seeking to extend a tariff truce beyond the Aug. 12 deadline.

Oil investors are also awaiting the U.S. Federal Open Market Committee meeting on July 29-30, where the U.S. central bank is expected to maintain the benchmark interest rates at their current levels.

"The likelihood of an economic slowdown and the Federal Reserve's potential rate cuts remain uncertain, limiting the upside in oil," Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova, said, according to a Reuters report.

Also See: LA Wildfires Propel Insured Losses To The Highest Level Since 2011 Fukushima Meltdown — Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)