Advertisement|Remove ads.

Oklo Stock Slips After Sam Altman Steps Down As Chair, But Retail Sentiment Flips To 'Bullish'

Shares of Santa Clara, California-based Oklo, Inc. (OKLO) fell in Tuesday's after-hours session after the company announced that OpenAI co-founder Sam Altman will step down as chairman of its board.

Altman has functioned as the company's chair since 2015.

In a statement, Oklo, which develops nuclear fission plants, acknowledged Altman's role in guiding the company since its inception and helping with execution.

Jacob DeWitte, Oklo's co-founder and CEO, said, "Sam has been instrumental in shaping Oklo's trajectory since the inception of Oklo."

DeWitte will take over as chairman and board member.

Fellow co-founder Caroline Cochran said the company will continue with its mission of bringing scalable clean energy to the artificial intelligence (AI) sector and others.

She also added that the company will continue exploring strategic partnerships with leading AI companies, potentially with OpenAI.

Altman, the outgoing chairman, said he believed it was now the right time to step down as Oklo, under the leadership of DeWitte and Cochran, is well positioned to meet the growing demands of fission as an energy source for AI and other critical industries.

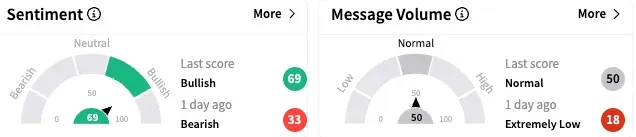

On Stocktwits, retail sentiment toward Oklo stock turned to 'bullish' (66/100) by late Tuesday from 'bearish' a day ago, with the message volume rising to 'normal' levels.

A watcher surmised that Altman's departure may not be negative for the company, given the opportunities for strategic alliances with AI companies.

Another user slammed sellers of the stock, as they shared a Financial Times story that said Altman's stepping down had to do with avoiding conflict of interests as OpenAI negotiates an energy deal with Oklo.

Oklo stock ended Tuesday's session up 5.59% to $21.53, rebounding along with the broader market. In the after-hours, however, it shed nearly 3%.

The stock has gained 1.4% this year.

Oklo made its public debut through the Special Purpose Acquisition Company route, with its stock beginning to trade on the Nasdaq on Oct. 5, 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)