Advertisement|Remove ads.

Olectra Greentech At Crossroads Ahead Of Q1 Earnings; SEBI RA Rohit Mehta Flags Levels To Watch

Ahead of Olectra Greentech’s results on August 9, SEBI-registered analyst Rohit Mehta breaks down the stock performance from a technical perspective.

According to Mehta, shares of the electric bus manufacturer have been in a sustained downtrend since peaking at its all-time high of ₹2,221 in February 2024, with the stock now down about 35%.

On the weekly chart, key support lies in the ₹948 - ₹1,013 zone, which recently triggered a bounce. However, the uptrend has faced resistance near the ₹1,426 zone, with the next major hurdle at ₹1,785, the analyst said.

A decisive break above ₹1,785 could mark a trend reversal and open the path towards retesting the all-time high, but on the downside, a fall below ₹948 could reignite bearish momentum, Mehta added.

On the fundamentals front, Olectra boasts an impressive 5-year profit CAGR of 123% and a 10-year median sales growth of 17.9%. However, valuations remain steep at 11.3x book value, while ROE has averaged a modest 10.6% over the past three years, he said. Borrowing costs remain relatively high.

For the March-June quarter, promoters have maintained their stake at 50.02%, while FIIs increased their holdings from 5.38% to 5.66% and DIIs from 0.45% to 0.48%.

Financially, the company is in good shape. In the March quarter, sales came in 55.4% higher and EPS grew 53.3%. However, sequentially, revenue fell 12.8% and EPS dropped 54.6%, reflecting near-term pressure, Mehta said.

Olectra Greentech shares were down 1.6% at ₹1,421 ahead of market close, having lost 2.3% year-to-date.

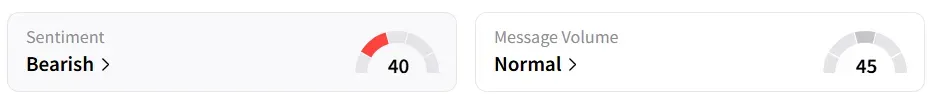

Retail sentiment on Stocktwits remained ‘bearish’. It was ‘neutral’ a week earlier.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)