Advertisement|Remove ads.

Olectra Greentech Shows Resilience: Buy Only Above ₹1,350, Says SEBI RA Mayank Singh Chandel

Olectra Greentech shares dropped nearly 7% in early trade on Tuesday following reports that the Maharashtra government cancelled a ₹10,000 crore electric bus order.

Despite this negative news, the stock showed resilience by bouncing sharply from the day’s low of ₹1,160, says SEBI-registered analyst Mayank Singh Chandel.

He highlighted that the stock is trading with high volumes (13.7 lakh+ shares traded), which indicates active interest. Also, there is visible strength on the bid side, which suggests support from buyers even after the news-triggered fall.

Chandel maintains a conditional ‘buy’ on Olectra Greentech. He advises traders to enter only if the stock gives a daily close above yesterday’s high (₹1,350) to confirm strength. Premature entries until this level is taken out with conviction should be avoided.

Beyond the news trigger, he observed that Olectra Greentech delivered an impressive blend of solid March quarter results and a bullish chart setup.

In the fourth quarter of FY25, Olectra’s growth story is evident with 219 electric vehicle deliveries compared to 131 last year. Revenues rose 55% to ₹448.92 crore, while profits rose 39% to ₹20.69 crore.

On the technical front, charts indicate a healthy comeback: the stock found support near the ₹981–₹1,017 zone, which coincides with the 61.8% Fibonacci retracement level. According to Chandel, the breakout above ₹1,345–₹1,350 suggests renewed bullish momentum.

He recommends an entry on a close above yesterday’s high of ₹1,350 with a stop loss below the recent swing low or ₹981–₹1,017 support zone.

Chandel believes that Olectra might just be gearing up for its next growth phase, making it a suitable candidate for one’s watchlist or portfolio.

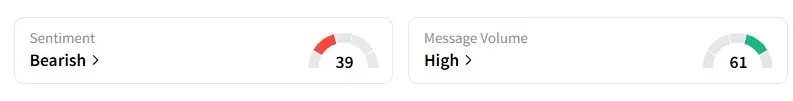

However, data on Stocktwits shows that retail sentiment turned ‘bearish’ on this counter a week ago, amid ‘high’ message volumes.

Olectra Greentech shares have fallen 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)