Advertisement|Remove ads.

Ollie’s Bargain Outlet Stock Rises After Q4 Earnings, Share Buyback Program: Retail Remains Cautious

Shares of closeout store Ollie’s Bargain Outlet rose 2% in after-hours trading Wednesday following the company’s fourth-quarter earnings, but retail sentiment was cautious.

For Q4, Ollie’s missed revenue estimates but its EPS of $1.19 was in line with Wall Street analyst expectations. Its revenue stood at $667.08 million, below street expectations of $675.39 million.

While comparable store sales increased 2.8% from the prior year, said the company.

“With so many retailers closing stores or going bankrupt in the past year, there are a considerable number of abandoned customers, merchandise, real estate, and talent in the marketplace,” said CEO Eric van der Valk.

“We think there is a unique opportunity to take on some of these assets in a manner that strengthens our competitive positioning, broadens our footprint, and bolsters shareholder returns for years to come.”

Ollie’s announced a new share repurchase authorization for an additional $300 million of the company’s outstanding common stock.

On the store expansion front, the company highlighted its purchase of an additional 40 former Big Lots store locations, paving the way to target store growth to 75 stores for fiscal 2025.

The company noted that its gross margin increased 20 basis points to 40.7%, primarily driven by lower supply chain costs, and offset by a slightly lower merchandise margin.

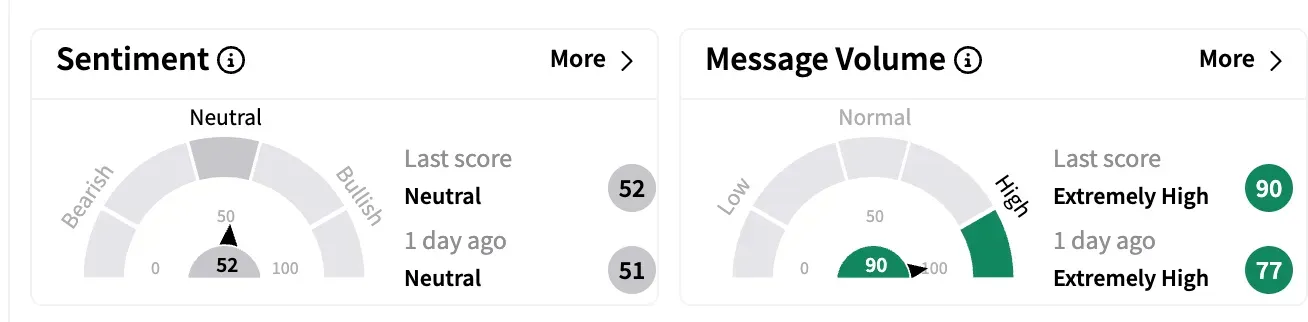

Sentiment on Stocktwits remained ‘neutral’ compared to a day ago. Message volume was ‘extremely high’

Olli sentiment meter and message volume on March 19 as of 11 pm ET

Ollie’s Bargain Outlet stock is down 1.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)