Advertisement|Remove ads.

ON Semiconductor Leaves Retail Traders Divided On Buzz Of Allegro Microsystems Buyout

Shares of ON Semiconductor Corp. (ON) will be in focus as markets open on Monday amid reports that the company is considering acquiring Allegro Microsystems Inc. (ALGM).

According to a Bloomberg report, ON Semiconductor has been working with advisors recently in its bid to acquire Allegro. It’s not clear yet if Allegro is looking for an acquisition offer.

Subdued demand from the automotive industry could push for consolidation among semiconductor players catering to this sector. Bloomberg data shows Allegro’s largest customer is Japan’s Sanken Electric Co., which makes power management integrated circuits, motor drivers, and other parts.

Both ON Semiconductor and Allegro offer semiconductor solutions to the automotive sector. As of Friday's close, ON Semi’s market capitalization was $19.8 billion, while Allegro’s was $4.1 billion.

Allegro makes power and sensing solutions for electric vehicles and energy-efficient products. Arizona-headquartered On Semi makes power and signal management solutions, logic, and custom devices for automotive, computing, and medical applications.

FinChat data shows the average price target for the ON Semiconductor stock is $61.04, implying a 30% upside from Friday’s closing price. Allegro’s price target was $29.75, indicating a 33% upside.

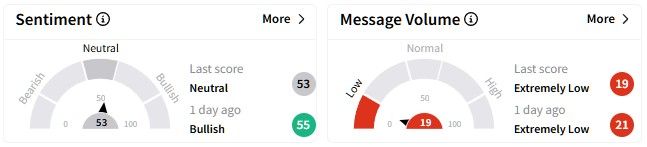

Data on Stocktwits showed uncertainty among retail investors on the platform, with sentiment hovering in the ‘neutral’ (53/100) territory.

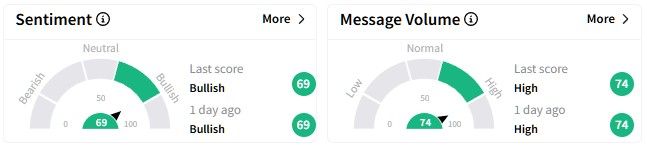

On the other hand, retail sentiment around Allegro was in the ‘bullish’ (69/100) territory at the time of writing.

ON Semiconductor’s stock has fallen more than 25% in 2025 to date, while Allegro’s shares have gained over 2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Enphase, Qualcomm, TSMC, Marvell, SealsQ: 5 Semi Stocks With Highest Retail Buzz Last Week

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)