Advertisement|Remove ads.

Top US Gainer Onconetix Makes Retail ‘Extremely Bullish’ After VC Firm Boosts Stake

Shares of Onconetix, Inc. (ONCO) surged more than 56% on Friday, making it the top gainer across U.S. exchanges, a day after an SEC filing revealed that Altos Venture AG had significantly increased its stake in the company, sending retail investors into a frenzy.

Altos reported a 32.5% stake in Onconetix as of Sept. 24, which equates to about 2.7 million shares. This stake was acquired through multiple transactions, including stock conversions. Altos also subscribed to the firm’s debentures worth $5 million.

One key transaction involved Altos converting 800,358 shares of Series B Convertible Preferred Stock into common shares.

The filing also mentioned that the latest disclosure accounted for ONCO’s recent completion of a 1-for-40 reverse stock split on Sept. 24.

Altos had previously disclosed a 5% stake in December 2023, when Onconetix was created through the merger of Blue Water Biotech and Proteomedix AG, a diagnostics-focused oncology company.

The merger transformed Onconetix into a cancer-focused business, with a portfolio that includes FDA-approved therapies like Entadfi for benign prostatic hyperplasia (BPH) and Proclarix, a prostate diagnostics test with European CE IVD approval.

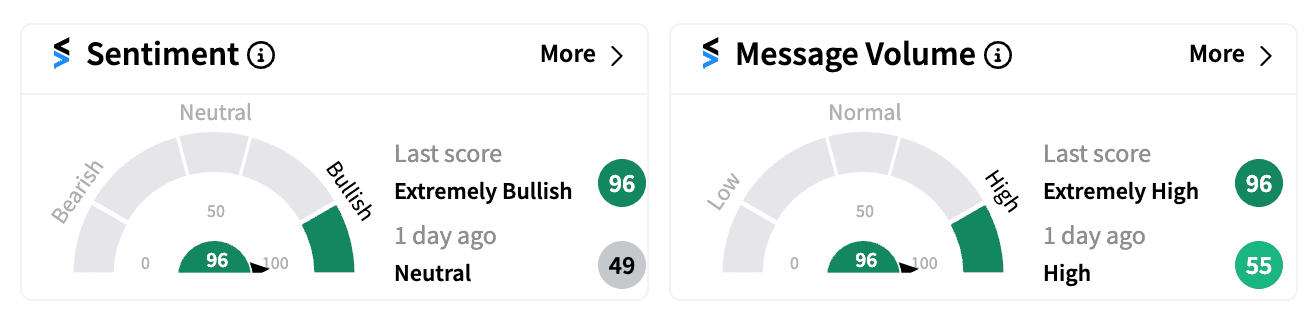

On Stocktwits, retail sentiment for ONCO skyrocketed to ‘extremely bullish’ (96/100) amid a surge in trading volume and message activity, as investors responded to Altos’ stake hike and potential activism.

However, ONCO shares remain down more than 30% year-to-date, indicating a broader recovery might still be needed.

Read next: Las Vegas Sands, Wynn Resorts Stocks Jump After China Stimulus, But Retail Investors Favor Only One

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)