Advertisement|Remove ads.

Opendoor Retail Activity Surges 300% After Reverse Stock Split Proposal Delayed: More Details Inside

Opendoor Technologies (OPEN) saw retail chatter surge over 300% on Stocktwits in the last 24 hours after the company on Monday adjourned a special meeting of shareholders, which was to be held to consider proposals related to a discretionary reverse stock split.

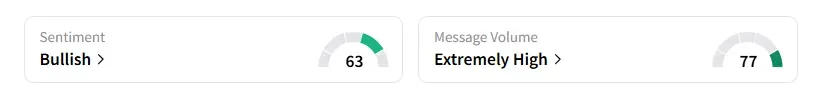

Shares of Opendoor were down 1% in premarket trading on Tuesday. Retail sentiment on the stock was in the ‘bullish’ territory, compared to the ‘extremely bullish’ a day ago, with message volumes at ‘extremely high’ levels, according to Stocktwits data.

The company said it received notice from Nasdaq in May that it had failed to comply with Nasdaq listing rules because the closing price of the shares was below $1 per share for 30 consecutive business days.

For Opendoor to be back in compliance with Nasdaq listing rules, the closing price of Opendoor’s common stock must be at least $1 per share for a minimum of 10 consecutive business days by Nov. 24, 2025, the company said.

The firm also pointed out that Nasdaq has not notified the company that it has regained compliance with listing requirements.

Opendoor said that with the stock facing heightened volatility, the board opted to delay the special meeting to give more time for reviewing market conditions and pricing trends.

The stock has gained nearly 50% year-to-date. The company said it was adjourning the scheduled meeting until August 27.

Opendoor has climbed nearly 160% since the July 14 closing price of $0.90 and was trading at $2.31 on Tuesday before the bell.

A Stocktwits user said the shares currently reflect a bearish trend.

According to Koyfin, short interest on Opendoor shares was around 19% as of Monday.

Over the last week, Kohl’s (KSS) and Opendoor’s stocks have rallied in a meme stock frenzy similar to GameStop during the pandemic, when the videogame retailer’s shares saw a sudden upswing and renewed interest from retail investors.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Leslie’s Stock Just Sank 25% And Retail Cannot Stop Talking About It: Here’s What Happened

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)