Advertisement|Remove ads.

Oppenheimer Downgrades Goldman Sachs To ‘Perform’ Over Lack Of Rebound In Mergers And Acquisitions Activity: Retail Stays Bearish

Retail investors remained bearish on Goldman Sachs Group Inc (GS) after Oppenheimer analyst Chris Kotowski reportedly downgraded the stock to ‘Perform’ from ‘Outperform’ while removing his price target of $709 per share. Goldman shares opened in the red on Wednesday morning.

According to a CNBC report, the primary catalyst for the downgrade was a “delayed or canceled” rebound in mergers and acquisitions (M&A) activity.

Kotowski said the brokerage is optimistic about a significant rebound in M&A activity and its attendant financing activity coming into the year.

“There is, however, thus far no visible sign of this M&A rebound… Moreover, we fear that the current uncertainty over tariffs, a fiscal ‘detox’ and the general upheaval of 80 years of trade and security arrangements is likely to cause a pause in M&A activity,” the analyst said, according to the report.

During the fourth quarter (Q4), the bank’s Global Banking & Markets division generated net revenues of $34.94 billion, driven by record net revenues in the Equities division and strong performances in Investment banking fees and Fixed Income, Currency, and Commodities (FICC). Investment banking fees rose 24% YoY to $2.05 billion.

The Oppenheimer analyst noted that he is adopting a more cautious stance on his coverage universe and is shifting his focus to stocks with the best secular growth stories.

The brokerage now assumes investment banking revenues will be flat compared to 2024 for the three remaining quarters of 2025. Earlier, the analyst forecasted revenues to become more normalized relative to GDP.

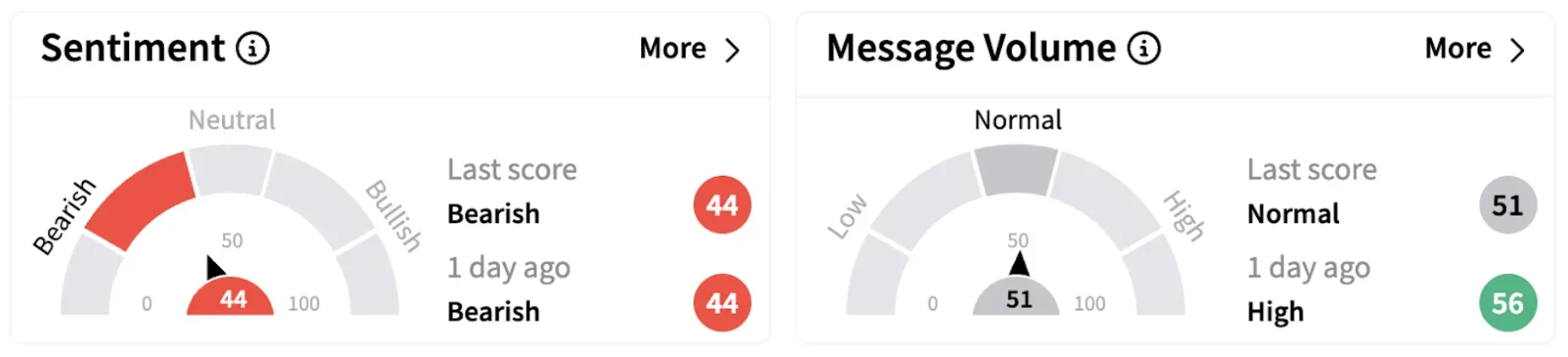

Meanwhile, on Stocktwits, message volume declined to ‘normal,’ and retail sentiment remained in the ‘bearish’ territory (44/100) following the downgrade.

GS shares have lost over 4% in 2025 and have gained over 41% in the past year.

Investors are keenly awaiting the Federal Reserve’s policy announcement on Wednesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)