Advertisement|Remove ads.

Pacira Biosciences Stock Rises On Multiple Price Target Upgrades: Retail Sentiment Soars

Shares of Pacira BioSciences Inc (PCRX) traded 19% higher on Tuesday morning, following upward price target revisions by multiple brokerages following a patent litigation settlement.

Pacira announced on Monday that it has settled its litigations related to patents for EXPAREL or bupivacaine liposome injectable suspension, a long-acting local pain reliever.

As part of the settlement, Pacira agreed to provide Fresenius Kabi USA, LLC with a license to Pacira’s patents required to manufacture and sell certain volume-limited amounts of generic bupivacaine liposome injectable suspension in the U.S. beginning on a confidential date sometime in early 2030.

Pacira also agreed to provide Fresenius with a license to Pacira’s patents required to manufacture and sell an unlimited quantity of generic bupivacaine liposome injectable suspension in the U.S. beginning no earlier than 2039.

Pacira CEO Frank D. Lee said Monday that the settlement agreement provides “clarity” around EXPAREL exclusivity.

Meanwhile, H.C. Wainwright raised the firm's price target on Pacira to $65 from $48 while keeping a ‘Buy’ rating on the shares.

The firm opined that the Street is "wildly overestimating" the company's Exparel generic risk and "dramatically underpricing" Pacira shares, according to TheFly.

RBC Capital also raised its price target on Pacira to $26 from $22 on Tuesday and maintained a “Sector Perform” rating on the shares.

Pacira BioSciences’ settlement of litigation for generic Exparel, which provides some closure to over a year's worth of overhang and uncertainty for shares, is a win for the company and the Exparel franchise, the analyst said.

It brings needed clarity and five years of protection to potentially realize the benefits of internal drivers, the analyst told investors in a research note.

Truist also raised its price target on Pacira to $28 from $25 and kept a ‘Hold’ rating on the shares. The firm now envisions peak Exparel sales of $740 million by 2029.

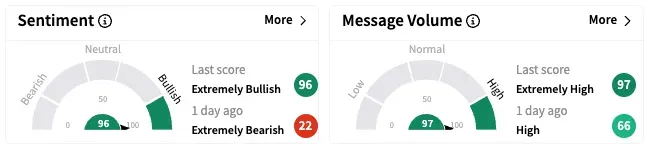

On Stocktwits, retail sentiment about PCRX jumped from ‘extremely bearish’ to ‘extremely bullish’ territory while message volume jumped from ‘high’ to ‘extremely high’ levels over the past 24 hours.

PCRX Shares have risen nearly 49% this year but have fallen over 4% over the past 12 months.

Also See: CVS Health Appoints New CFO, Chief Medical Officer: Retail Sentiment Soars

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)