Advertisement|Remove ads.

Palantir Surges Ahead: Retail Optimism Soars As Stock Outpaces Market And Mega-Caps

Palantir Technologies, Inc. (PLTR) stock is the best-performing S&P 500 stock this year, having advanced over 51%.

The stellar gains came about despite President Donald Trump's tariffs, which hit the broader market hard, with tech stocks taking a big hit.

Standout Gains

The returns from Palantir are better than those of the Roundhill Magnificent Seven ETF (MAGS), which is a proxy for the performance (-15%) of the biggest seven mega-cap stocks going by the moniker "Magnificent Seven."

Chart courtesy of TradingView

The SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) tracking the broader S&P 500 Index, and the Invesco QQQ Trust (QQQ) ETF, which tracks the Nasdaq 100 Index, are down over 5.8% and 7.4%, respectively, so far this year.

Despite its outperformance, the Palantir stock is trading well below its all-time high of $125.41, which it hit on Feb. 19.

What's Driving Rally?

Palantir's stellar quarterly results drove the stock above the $100 psychological barrier in early February.

The stock came under selling pressure after it peaked past the $125 level amid concerns about valuation and anxiety stirred by potential Department of Defense (DoD) spending cuts amid the Department of Government Efficiency (DOGE) initiatives.

Palantir pulled back to a low of $74 on March 10 before resuming its uptrend but came under renewed selling pressure amid the tariff-induced market sell-off.

This time, the stock dropped to $66.12 (April 7) but has climbed about 74% since then.

A North Atlantic Treaty Organization (NATO) contract for Palantir's Maven Smart System for AI-enabled battlefield operations on April 4 fueled a nearly 5% rally in the stock.

Subsequently, the company announced that AI startup Anthropic will leverage Palantir's FedStart to make its Claude large-language model (LLM) available to the government sector.

Palantir's FedStart is a software-as-a-service offering that enables companies to run their products within Palantir's Federal Risk and Authorization Management Program (FedRAMP) and Impact Level (IL) accredited environment.

Separately, the Immigration and Customs Enforcement reportedly awarded a $30 million contract for Palantir to deploy its software add-ons to track immigrants overstaying their visas.

The U.S. government accounted for 63% of Palantir's revenue in 2024.

The stock could build additional momentum going into the company's first-quarter report, which is due after the market closes on May 5.

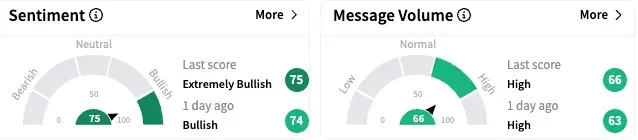

On Stocktwits, retail sentiment toward Palantir stock turned to 'extremely bullish' late Monday from the 'bullish' mood a day ago, with the message volume at 'high' levels.

Palantir stock ended Monday's session up 1.66% at $114.65. The sell-side, however, isn't that optimistic. The Koyfin-compiled consensus analysts' price target for the stock is $87.04, a 24% discount to Monday's closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: PELOSI Act' Returns: GOP Senator Josh Hawley Renews Effort To Ban Congressional Stock Trading

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)