Advertisement|Remove ads.

Palantir Stock Eyes Break Above $100 As Investors Cheer Blowout Quarter, Bullish Guidance: Retail Excitement Abounds

Palantir Technologies, Inc. (PLTR) stock is on track to open sharply higher on Tuesday after the artificial intelligence-powered data analytics company reported solid fiscal year 2024 fourth-quarter results.

Denver, Colorado-based Palantir reported fourth-quarter adjusted earnings per share (EPS) of $0.14, higher than the year ago’s $0.08 and the consensus of $0.11.

Revenue climbed 36% year over year (YoY) and 14% quarter over quarter (QoQ) to $828 million. The topline beat the $775.91 billion consensus estimate and the guidance of $767 million to $771 million.

The adjusted income from operations was $373 million, also exceeding the guidance range of $298 million to $302 million.

Among the business segments, U.S. commercial revenue grew 64% YoY and 20% sequentially to $214 million, accounting for about 29% of the total.

U.S. government revenue climbed 45% YoY and 7% QoQ to $343 million, or 41% of the total revenue.

Palantir said it closed 129 deals worth at least $1 million, 58 of which were valued at least $5 million and 32 at least $10 million.

U.S. commercial total contract value climbed 134% YoY and 170% sequentially to a record $803 million, and U.S. commercial remaining deal value (RDV) jumped 99% YoY and 47% QoQ to $1.79 billion.

Customer count was up 43% YoY and 13% sequentially.

Palantir ended the quarter with a cash position of $5.2 billion.

CEO Alex Karp said, “Our business results continue to astound, demonstrating our deepening position at the center of the AI revolution.”

“Our early insights surrounding the commoditization of large language models have evolved from theory to fact.”

Looking ahead, the company guided revenue of $858 million to $862 million for the first quarter and $3.741 billion to $3.757 billion for the fiscal year 2025.

Analysts, on average, estimate revenue at $813.86 million and $3.52 billion, respectively.

The company expects adjusted operating income of $354 million to $358 million for the first quarter and $1.551 billion to $1.567 billion for the year.

Following the results, the stock received several price target hikes, TheFly reprorted. Morgan Stanley shed its bearish stance and upgraded the stock to ‘Equal-Weight’ with a $95 price target, up from $60. BofA Securities lifted the price target to $125 from $90.

Although Jefferies maintained an ‘Underperform’ rating, it increased the price target to $60 from $28.

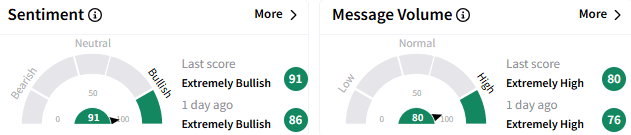

On Stocktwits, retail sentiment toward Palantir stock climbed further into the ‘extremely bullish’ territory (91/100), with message volume staying at ‘extremely high’ levels.

Palantir was the top trending stock on Stocktwits early Tuesday and among the platform's top five active tickers.

A retail stock watcher said Palantir could be in for a Nvidia-like rally. Another predicted a short squeeze in the works. According to Yahoo Finance, the short percentage of the outstanding shares is 3.68%.

Palantir stock jumped 19.80% in pre-market trading to $100.32, marking a record high. This also marked the biggest one-day change since the 23.5% jump on Nov. 4 when the company released its third-quarter results.

Palantir climbed 340% in 2024 and has tacked another 10.7% since then.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)