Advertisement|Remove ads.

Palantir Stock Remains Expensive Even If It Were To Match OpenAI’s Sky‑High Valuation Metrics, Says Citron Research

Palantir Technologies Inc. (PLTR) remains expensive even if it were to match OpenAI’s sky‑high $500 billion valuation metrics, said Citron Research on Monday, questioning whether the software provider’s stock price reflects underlying fundamentals or market hype.

The firm said Palantir might seem like a bargain at $40 per share, but the stock is pricey, even at that level.

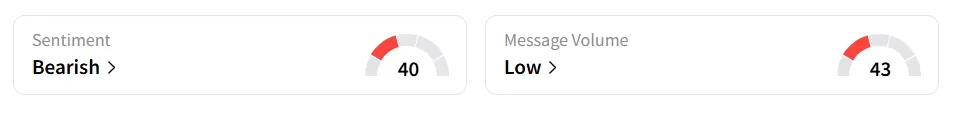

Palantir Technologies' stock traded over 2% lower on Monday afternoon. On Stocktwits, retail sentiment toward the stock remained in the ‘bearish’ territory. Message volume shifted to ‘low’ from ‘normal’ levels in 2 hours.

A Stocktwits user suggested avoiding the stock.

OpenAI is expected to garner $29.6 billion in 2026 revenue, translating to a price‑to‑sales (P/S) multiple of about 17x. Applying this same multiple to Palantir, expected to earn $5.6 billion in that year, yields an implied stock price near $40. But even then, the firm says, Palantir would still be expensive.

OpenAI follows a SaaS (software as a service) subscription approach that scales effectively, while Palantir relies heavily on long‑term government contracts. The latter model limits rapid expansion, reducing its appeal compared to that of OpenAI’s.

OpenAI has a vast and growing user base, solidifying a loop where each new user strengthens its AI models. In contrast, Palantir’s growth stems from tailored deployments, earning customer loyalty but lacking the compounding benefits of platform usage.

Citron Research stated that Wall Street analysts often hype stocks, and Palantir is no exception. While early buyers may have benefited, it’s now time to look at the risks, it said.

If Palantir’s own software reviewed its stock, it would likely find that growth is slower than other AI companies, it's too reliant on government deals, and its stock is priced much higher than peers, concluded the firm.

Palantir stock has gained over 129% in 2025 and over 433% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)