Advertisement|Remove ads.

Patterson-UTI Stock Trades In Red Pre-Market After Q4 Revenue Miss: Retail Stays Bearish

Patterson-UTI Energy Inc (PTEN) shares edged lower on Thursday after the fourth-quarter revenue missed Wall Street estimates.

The oilfield services firm’s quarterly revenue fell 26.6% to $1.16 billion compared to last year. Analysts, on average, expected the company to post $1.25 billion in revenue, according to Koyfin data.

Patterson-UTI posted a net loss of $51.6 million, or $0.13 per share, for the quarter ending Dec. 31, compared to a net income of $62 million, or $0.15 per share, in the year-ago quarter.

The company’s drilling services revenue fell to $408.4 million from $463.6 million last year, while well-completion revenue declined nearly 36% to $650.8 million.

The Houston-based company said several larger customers slowed down completion activity after reaching their annual production targets.

Oil and gas producers have focused on production discipline amid volatile commodity prices. This, along with efficiency gains, has weighed in on demand for oilfield services.

CEO Andy Hendricks said that for the remainder of 2025, the company expects the U.S. shale drilling market to remain relatively steady. “We are confident in our ability to improve returns over the next several years, even if U.S. onshore activity remains steady near current levels."

The company expects a seasonal uptick in activity during the first quarter in its completion services segment as customer budgets reset with the start of the new year.

Patterson-UTI forecasts 2025 capital expenditure of $600 million, with all its segments budgeting for lower spending than 2024.

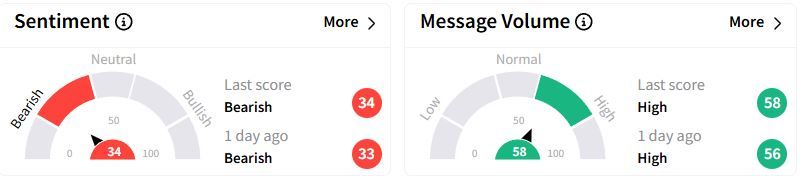

Retail sentiment on Stocktwits remained in the ‘bearish’ (34/100) zone, while retail chatter was ‘high.’

In January, larger U.S. oilfield peer Halliburton, flagged weak activity in North America in 2025 after missing fourth-quarter revenue estimates.

Over the past year, Patterson-UTI shares have fallen 20.6%.

Also See: Ford Stock Tumbles On $2B Profit Hit Warning While Retail Finds Relief In Q4 Beat

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)