Advertisement|Remove ads.

PayPal Stock Tumbles Despite Upbeat Q4: But Retail Rejoices The Earnings Report

PayPal Holdings Inc (PYPL), on Tuesday, reported fourth-quarter earnings that topped analyst estimates but failed to cheer investors, with the stock tumbling over 10% on Tuesday.

Revenue rose 4.26% year-over-year (YoY) to $8.37 billion compared to a Wall Street estimate of $8.28 billion, according to FinChat. Earnings per share (EPS) came in at $1.19 versus an analyst estimate of $1.12.

Total payment volume (TPV), which reflects the performance of digital payments in the economy, rose 7% to $437.8 billion in the fourth quarter (Q4). However, according to a CNBC report, the figure fell short of the $438.2 billion projected by analysts. Payment transactions decreased 3% to 6.6 billion.

For the first quarter, PayPal anticipates adjusted EPS of $1.15 to $1.17— higher than the average analyst estimate of $1.13. For 2025, EPS is expected to come in at $4.95 to $5.10, beating an estimated $4.90.

The firm’s board of directors has authorized a new $15 billion stock repurchase program, in addition to the company’s June 2022 stock buyback program, which had $4.86 billion remaining authorization as of Dec. 31, 2024.

Meanwhile, mobile payment service Venmo’s total payment volume rose 10% year-over-year.

CEO Alex Chriss said PayPal said the improvements made to branded checkout, peer-to-peer, and Venmo, plus the progress made on the price-to-value strategy, are beginning to show up in the results. “The strong momentum we’ve created sets us up well for 2025, which is about scaling adoption,” Chriss said.

Despite the positive earnings report, PayPal stock tumbled on Tuesday. According to a Barron’s report, Mizuho analyst Dan Dolev noted that branded total payment volume growth of 6% fell short of targets, adding that “the health of the Branded Checkout button is the heart of the debate around the future of PYPL.”

The analyst rates PayPal at ‘Outperform’ with a price target of $100.

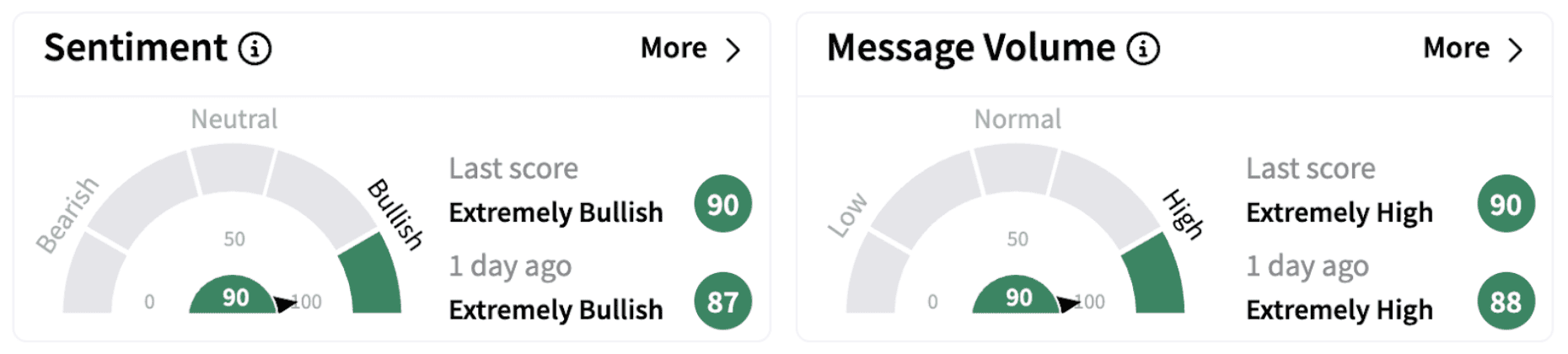

Despite the decline in stock price, retail sentiment on Stocktwits continued to trend in the ‘extremely bullish’ territory (90/100), accompanied by significant retail chatter.

Most retail chatter on Stocktwits indicates a positive take on the stock, with some believing the current dip presents a good buying opportunity.

PayPal shares have lost over 6% year-to-date but are up over 31% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)