Advertisement|Remove ads.

Paysafe Stock Tumbles Pre-Market After Disappointing Q4 Earnings, 2025 Guidance: Retail Stays Bearish

Shares of online payments company Paysafe (PSFE) slid over 14% in Tuesday’s pre-market session after its fourth-quarter earnings and full-year 2025 guidance failed to meet Wall Street expectations.

For the fourth quarter (Q4), revenue increased 1% year-over-year (YoY) to $420.1 million compared to a Street estimate of $423.89 million, per Koyfin data. Adjusted earnings per share (EPS) dipped to $0.48 versus $0.66 last year and failed to beat an analyst estimate of $0.70.

The company reported a net income of $33.5 million, compared to a net loss of $12.1 million in the same quarter a year ago. This reflected an increase in other income due to a gain on foreign exchange and an income tax benefit of $17.7 million.

Paysafe said its Q4 results were significantly impacted by accelerated merchant exits and associated credit losses during the quarter, reflecting the company's strategic decision to reduce its exposure to direct marketing.

This had an unfavorable impact on Q4 reported revenue growth for the total Paysafe and the Merchant Solutions segment of approximately three percentage points and five percentage points, respectively.

CEO Bruce Lowthers highlighted that the company made significant progress, delivering on priorities and executing its three-year growth plan.

“In 2025, our mission is clear: drive revenue through product innovation, improve sales efficiency, create new partnerships, and scale for better customer and employee experiences. With our foundational turnaround now behind us, we are looking forward to our third year of organic revenue growth,” he said.

Passage’s guidance for 2025, however, failed to boost investment sentiment. The company projected a revenue of $1.710 billion to $1.734 billion for the year, lower than a Wall Street estimate of $1.79 billion.

Paysafe expects adjusted EPS of $2.2 to $2.51 for the year, compared to an analyst estimate of $3.04.

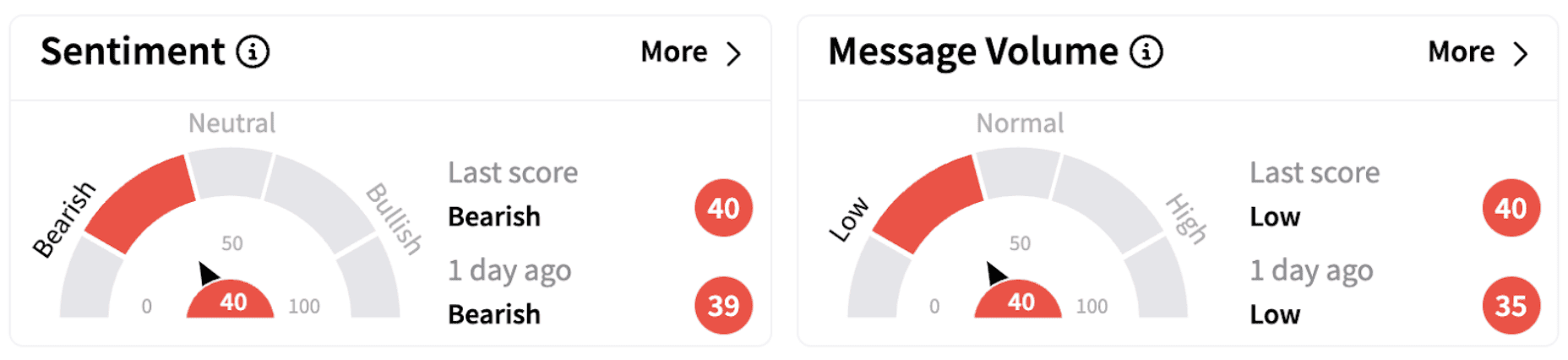

On Stocktwits, retail sentiment inched higher marginally but continued to trend in the ‘bearish’ territory (40/100).

Paysafe also announced it has recently received unsolicited preliminary non-binding expressions of interest.

The company said that its board remains confident in its prospects as a stand-alone company and in its ability to continue to create shareholder value. “However, in accordance with its fiduciary responsibilities, the Board, with its financial and legal advisors, will consider any proposals that maximize shareholder value,” the company noted.

Paysafe also clarified that its board has not initiated a sale process and is only reviewing the unsolicited proposals.

One Stocktwits user expressed disappointment at the results.

Paysafe shares have risen over 11% in 2025 and gained over 34% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)