Advertisement|Remove ads.

Penn Entertainment Faces Intense Clash With Activist Investor After Trimming Board Seats — Retail Traders Turn Bullish

Activist investor HG Vora Capital Management criticized casino and sports betting firm Penn Entertainment (PENN) on Monday for shrinking its board to avoid appointing three nominees from the hedge fund.

HG Vora, which holds a less than 5% stake in Penn, said the company's action was "self-serving" and that it would continue pushing for board representation.

Penn shares were down 2.5% in extended trading after falling 2% in the regular session on Monday.

On Friday, Penn Entertainment said it intended to appoint two of HG Vora's three proposed nominees and was shrinking the board by one to eight directors, leaving only two seats available for voting at the June meeting.

In a statement, HG Vora also questioned whether Penn would follow through and name its nominees, Johnny Hartnett and Carlos Ruisanchez, executives with gaming industry experience, as incoming directors.

The activist investor has expressed concerns over Penn's investment in online gaming. It alleges that the company wasted about $4 billion attempting to break into the online sports betting industry, leading to erosion in shareholder value.

Penn shares are down 87% from their all-time high in 2021.

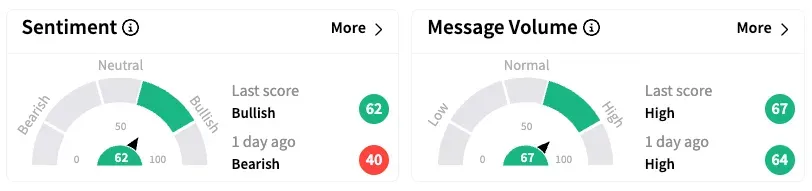

On Stocktwits, retail sentiment turned 'bullish' from 'bearish' a day earlier.

One user recommended voting for HG Vora's proxy.

Penn operates 43 properties in 20 U.S. states under brands including Hollywood Casino, Ameristar, and Boomtown, and also operates the ESPN Bet website.

Its stock is down 20.2% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)