Advertisement|Remove ads.

PepsiCo Q2 Earnings Preview: Analysts See Longer Road To Revival In Snacks Business

PepsiCo (PEP) is set to report another quarter of revenue and earnings declines in its second-quarter results on Thursday, as analysts and investors watch closely for insights into its sluggish North American business.

The soda and snacks giant has been under pressure for several quarters, weighed down by shifting consumer preferences toward healthier options, stiff competition from Coca-Cola (KO) and Keurig Dr Pepper (KDP), and broader weakness in consumer spending amid elevated inflation.

The biggest drag on performance is PepsiCo's Frito-Lay snacks division, which continues to show weakness in its core North American market. Alongside shifting consumer preferences, analysts point to the sharp price increases since the COVID-19 pandemic as a key factor weighing on sales.

"We see sustained top-line pressure this year and expect things to get worse before they get better," RBC analysts said in a June investor note. "For investors to have confidence in (Pepsi's) outlook, we believe we need to have greater visibility into the domestic topline trajectory, and the single biggest unlock is the recovery of snacking volumes."

According to Koyfin data, PepsiCo is expected to report a 1% drop in Q2 revenue, its fourth straight quarter of sales decline. Wall Street expects adjusted earnings to fall to $2.03 per share from $2.28 last year.

Analysts said while the results will show headwinds in the core business, commentary around key demand trends, including the impact of tariffs, will set investors' position on the stock.

We "see this quarter and the surrounding discussion of (PepsiCo's) future priorities/initiatives meaningfully important to build confidence that the future will be different (i.e., better) than the recent past," Deutsche Bank analysts said in a note.

In April, the company cut its fiscal 2025 earnings outlook amid anticipated cost pressures from U.S. tariffs.

While PepsiCo shares have rebounded in recent weeks, likely boosted by pre-earnings buying, they remain down 10.8% year-to-date. Over the same period, the benchmark S&P 500 (SPX) has gained 6.6%.

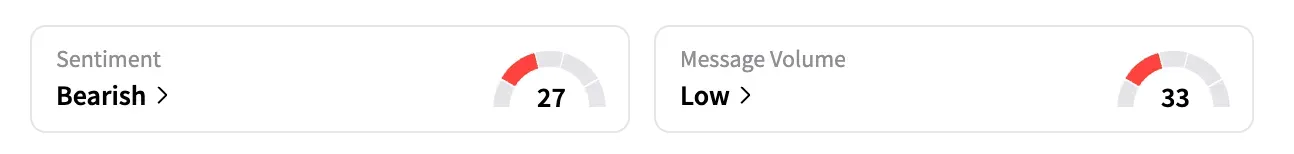

On Stocktwits, the retail sentiment for PepsiCo was 'bearish,' unchanged from a month ago.

A user posted about a report that said consumers were ditching sodas for water, coffee, and healthier drink alternatives. They added that Pepsi's products are still expensive and "they are pricing themselves out."

UBS said, "The core debate centers around PepsiCo's ability to turn around its struggling North American business," adding that it is positive long-term on the business and expects no change to the company's 2025 outlook.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_blue_original_jpg_b6e7cc57f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)