Advertisement|Remove ads.

PepsiCo Q3 Earnings Preview: Revenue Growth On The Cards, But North American Snack Business Lags

PepsiCo investors will expect a revival plan for the company's underperforming snacks business and broader growth plans amid an activist campaign when the company reports its third-quarter results before the market opens on Thursday.

The company's Frito-Lay snacks business had been struggling, particularly in North America, and analysts say the company needs to reduce prices, tweak the product mix, including adding some protein-based items, and push for volume growth.

The company's results would also show to what degree additional costs and changing consumer trends, both tied to the U.S. trade tariffs, are impacting the packaged consumer foods industry.

Analysts expect PepsiCo to report a 2.3% rise in revenue, its best performance in the last six quarters, according to Koyfin data. Adjusted profit is expected to decline by 2.2%, marking the third consecutive quarter of decline.

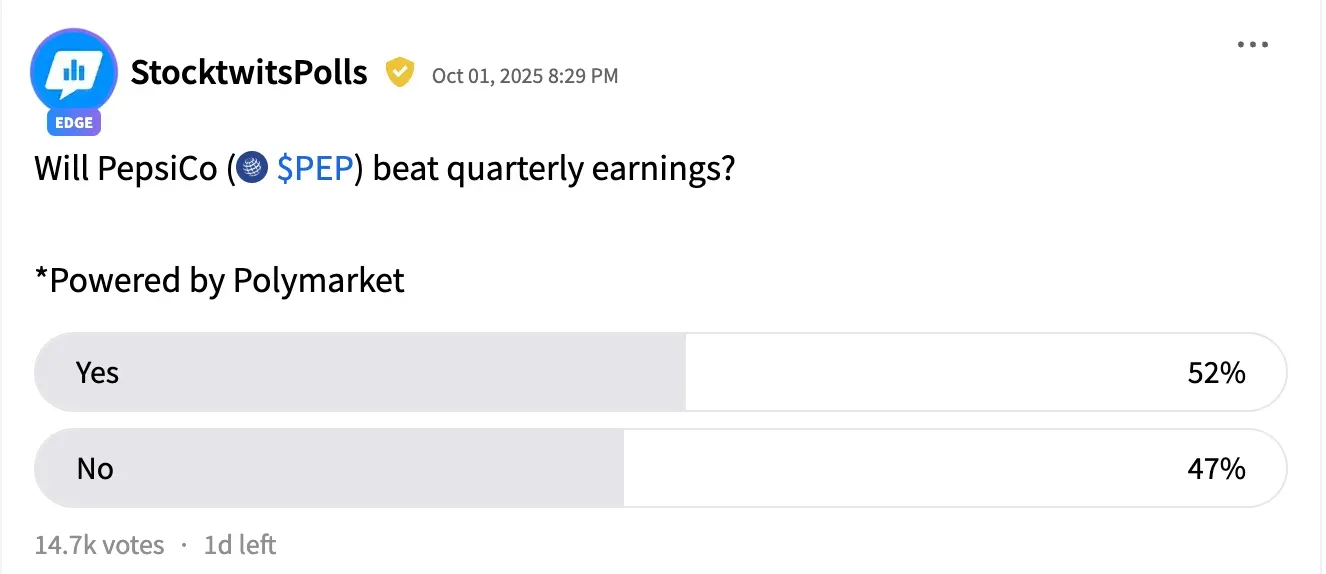

Results of a Stocktwits-Polymarket poll, in which approximately 14,700 participants voted, showed that 52% expect an earnings beat, while 47% expect a miss.

PepsiCo is expected to report another difficult quarter, as topline performance in North America continues to show signs of weakness, particularly in the Frito-Lay snacks segment, according to a note from RBC Capital Markets last week.

Notably, several brokerages, including JPMorgan, Barclays, and Citigroup, lowered their price targets on the company's shares in recent weeks.

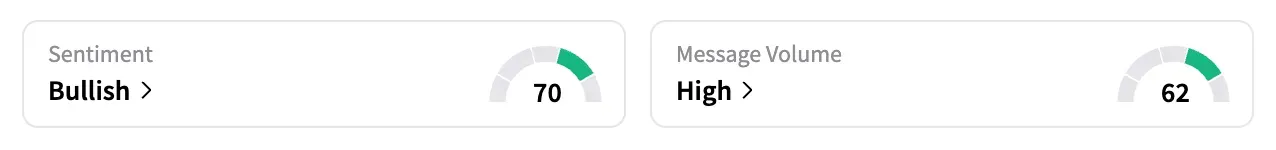

On Stocktwits, the retail sentiment for PEP has remained 'bullish' so far this week.

Shares of PepsiCo are down approximately 8% year-to-date and 16% over the last 12 months. In comparison, Coca-Cola's shares have risen by 7% year-to-date.

Currently, 15 of the 23 analysts covering PEP have a 'Hold' rating on the stock, six rate it 'Buy' or higher, and two rate it 'Sell,' according to Koyfin data. For KO, an overwhelming 22 of the 25 analysts recommend a 'Buy,' while just three recommend 'Hold.'

Last month, activist investor Elliott Investment Management disclosed a $4 billion stake in PepsiCo, making it among the consumer giant's top five active investors, excluding index funds.

Elliott said it believes PepsiCo shares can see at least a 50% upside, and suggested that the company should evaluate the potential refranchising of its bottling network and divesting non-core and underperforming assets.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)