Advertisement|Remove ads.

'Forget About Bitcoin' — Peter Schiff Says This Commodity Is A 'Faster Horse' Than Gold

- U.S. President Donald Trump on Wednesday signed a bill to end the longest shutdown in U.S. history and keep the Federal Government open till Jan. 30, 2026.

- On Monday, Goldman Sachs analysts estimated that U.S. non-farm payroll likely fell by 50,000 in October.

- The tepid jobs data from private-sector participants and weak consumer sentiment could likely force the U.S. Federal Reserve to lower the benchmark interest rate by 25 basis points.

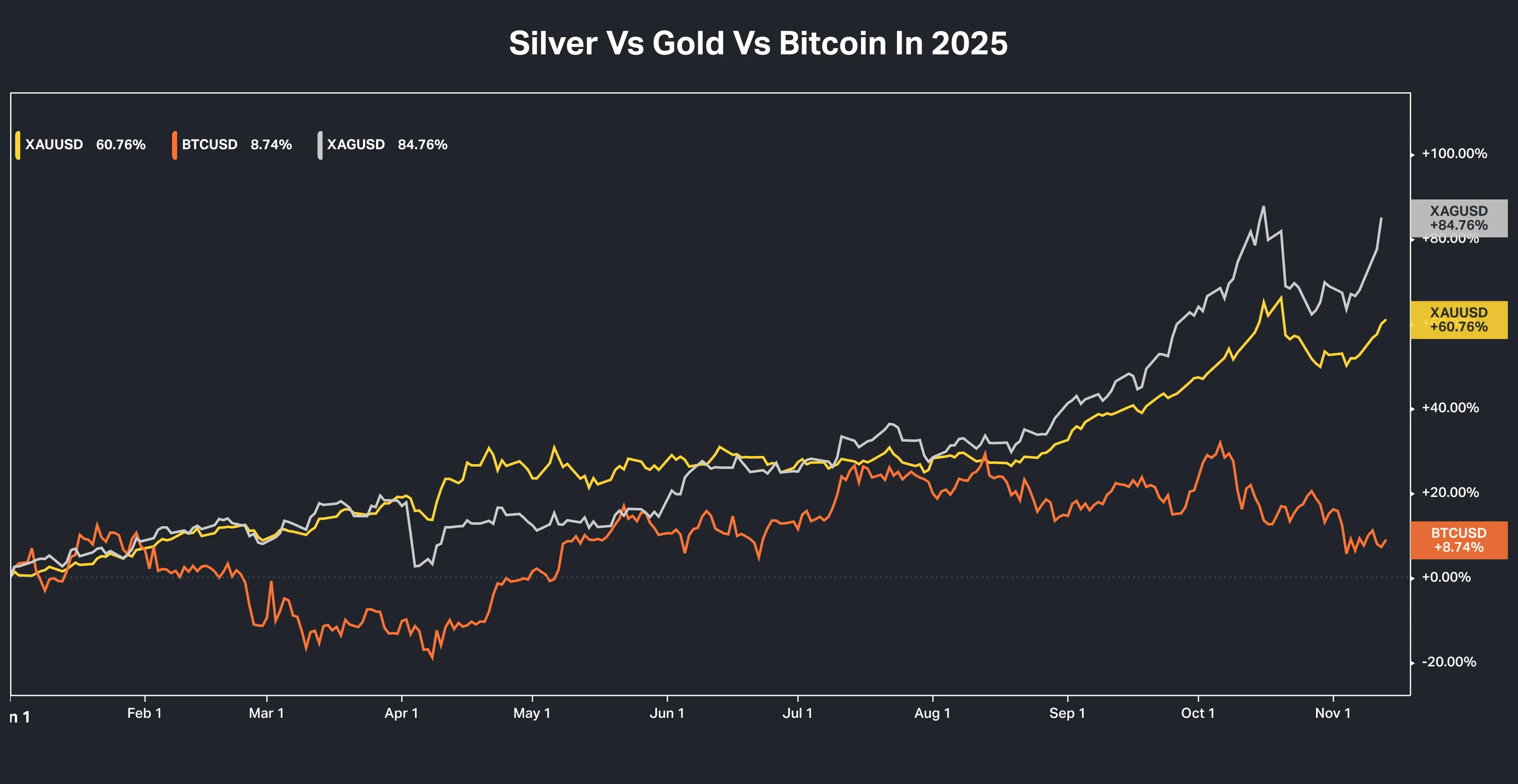

Peter Schiff, a renowned gold bull, said that if investors want even better returns than the bullion, they should “ride on” silver.

Spot silver prices gained over 1.5% to about $54 per ounce, inching closer to the all-time highs of $54.47 per ounce, which it hit last month. “Forget about Bitcoin. If you want a faster horse than gold, take a ride on silver,” Schiff wrote on X.

What Is Driving Silver Prices?

U.S. President Donald Trump on Wednesday signed a bill to end the longest shutdown in U.S. history and keep the federal government open till Jan. 30, 2026. The shutdown kept several government workers at home and delayed the release of job data in September and October.

On Monday, Goldman Sachs analysts estimated that U.S. non-farm payroll likely fell by 50,000 in October. The firm’s job growth tracker slowed to 50,000 new jobs in October from 85,000 in September, and Goldman estimated that the government’s deferred-resignation program might have cut payrolls by about 100,000 positions.

The tepid jobs data from private-sector participants and weak consumer sentiment could likely force the U.S. Federal Reserve to lower the benchmark interest rate by 25 basis points, once again in December. According to CME Group’s FedWatch tool, over 53% traders expect a rate cut in the Fed’s next meeting, slightly lower than the day before.

What Are Stocktwits Users Thinking?

Retail sentiment on Stocktwits about iShares Silver Trust (SLV) moved to ‘neutral’ from ‘bearish’ a day ago.

“$60 silver in 2025 is a given,” one bullish user said.

Silver prices have jumped 84% this year, even outperforming gold’s 60% gains, amid a supply squeeze that has since eased a bit. However, some analysts believe the precious metals have more room to run.

"Could the metal prices go lower? Of course they can. But is what we've seen in these past couple of weeks, given the context it occurred within — is that an indication that this rally is definitely over? I would suggest not," said Chris Marcus, the founder of Arcadia Economics, on a podcast.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)