Advertisement|Remove ads.

Peter Schiff Says Trump Is Incorrect To Attribute US Wealth In 1880s And 1890s To Tariffs – Suggests Ways On How To Be Rich Again

- The economist also laid out a roadmap to make the U.S. rich again, as in the 1880s, starting with eliminating 90% of the federal government.

- Schiff also stated that government agencies such as the SEC, FBI, CIA, and FCC, among others, should be eliminated, except for programs such as Social Security, Medicare, and Medicaid.

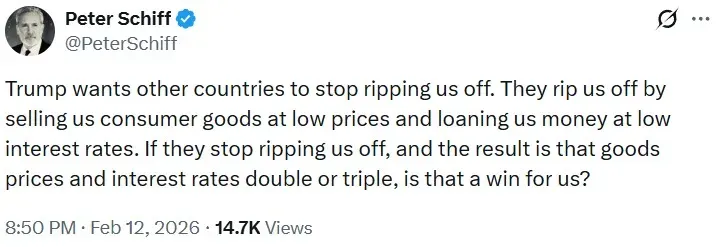

- In another post on X, the economist also called out President Trump’s comments about other countries ripping off the U.S.

Economist Peter Schiff on Thursday opined that President Donald Trump is correct in pointing out that the United States was at its richest in the 1880s and 1890s, but is wrong to attribute that wealth to tariffs.

“The reason we were so rich back then is that government was so tiny that we could afford to pay for it with tariffs. Back then, total federal spending was only about 2% of GDP. Today it’s over 23%,” he said in a post on X.

Eliminating Federal Government Departments

The economist also laid out a roadmap to make the U.S. rich again, as in the 1880s, starting with eliminating 90% of the federal government, which would make it possible to pay for the remaining 10% with tariffs.

He also called for the elimination of the Federal Reserve and a return to the gold standard.

“Let's get rid of income and Social Security taxes. Let's eliminate all the government departments created since 1890, like Commerce, Labor, Health, Education, Housing, Transportation, Energy, and Education,” the economist said.

Schiff also stated that government agencies such as the SEC, FBI, CIA, and FCC, among others, should be eliminated, except for programs such as Social Security, Medicare, and Medicaid.

“We should also repeal almost every federal law that has been passed since 1900. If we do all of that, then we can have tariffs and be rich again like we were in the 1880s and 1890s,” he added.

In another post on X, the economist called out President Trump’s comments about other countries ripping off the U.S. “They rip us off by selling us consumer goods at low prices and loaning us money at low interest rates. If they stop ripping us off, and the result is that goods prices and interest rates double or triple, is that a win for us?” he said.

What Did Trump Say?

Back in January 2025, President Trump promised that more tariffs would be coming after he announced levies on China, Canada, and Mexico.

“We were at our richest from 1870 to 1913. That’s when we were a tariff country, and then they went to an income-tax concept. And, you know, how did that work out? It’s fine, it’s OK, but it would have been very much better,” stated Trump.

During his inaugural address, the U.S. President praised former President William McKinley, saying that he “made our country very rich through tariffs and through talent.”

A little over two months later, the Trump administration announced “Liberation Day” tariffs.

Meanwhile, U.S. equities declined in Thursday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.76%, the Invesco QQQ Trust ETF (QQQ) fell 1.3%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.51%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 20+ Year Treasury Bond ETF (TLT) was up by 0.71% at the time of writing, while the iShares 7-10 Year Treasury Bond ETF (IEF) rose 0.37%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)