Advertisement|Remove ads.

Pfizer Stock Jumps Pre-Market On Report Of Activist Investor Starboard Buying $1B Stake, Retail Turns ‘Bullish’

Shares of pharmaceutical giant Pfizer Inc. ($PFE) climbed more than 3% in Monday’s pre-market trading, following reports that activist investor Starboard Value has taken a $1 billion stake in the company.

Starboard is pushing for a turnaround at Pfizer, the Wall Street Journal reported late on Sunday, citing people familiar with the matter.

The activist investor has reportedly approached former Pfizer executives Ian Read (CEO from 2010 to 2018) and Frank D’Amelio (CFO from 2007 to 2021) to help drive changes. Both executives have expressed interest in supporting the company’s new direction, according to sources cited by the Journal.

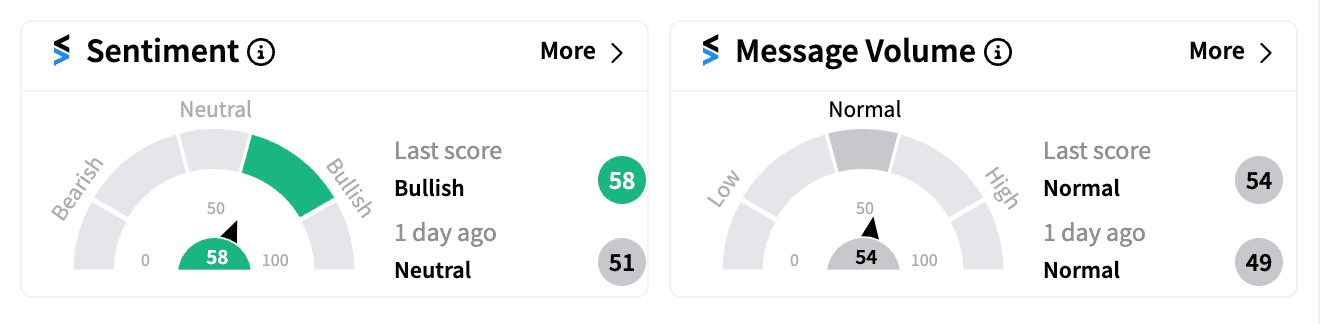

On Stocktwits, Pfizer’s stock, followed by nearly 100,000 retail investors, saw its sentiment shift from ‘neutral’ to ‘bullish’ (58/100) following the news.

Retail investors expressed renewed optimism, with one user stating “good things” are “finally” happening for PFE, while another highlighted the potential for Pfizer’s stock based on its existing drug pipeline.

Pfizer’s stock surged during the pandemic, driven by the success of its COVID-19 vaccine, peaking at around $59 in late 2021. However, the company’s shares have since fallen more than 50%, as revenues from pandemic-related treatments have dwindled, and the company struggles to find its next blockbuster drug.

In an attempt to pivot, Pfizer spent $43 billion last year to acquire Seagen Inc., betting on cancer drugs as a new growth engine.

But the company has faced setbacks, including the failure of an obesity pill and an experimental gene therapy for Duchenne muscular dystrophy.

Last month, Pfizer pulled a sickle-cell treatment from the market due to concerns about its safety, following the acquisition of Global Blood Therapeutics in 2022.

Some analysts have criticized Pfizer’s heavy reliance on mergers and acquisitions, arguing that the company should prioritize internal R&D to drive innovation. Not surprisingly, the stock is down nearly 3.8% this year.

Starboard, led by Jeff Smith, is known for pushing changes in tech firms, according to CNBC.

Read next: Palantir Stock Defies Market Turmoil To Hit Over 3-Year Highs, Retail Excitement Runs High

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)