Advertisement|Remove ads.

Pfizer's Retail Following Gets A Dose Of Cheer After Q3 Earnings Wallop Estimates

Shares of Pfizer Inc. ($PFE) gained over 1.5% pre-market Tuesday following a strong third-quarter earnings beat, which lifted retail sentiment.

The pharmaceutical giant posted adjusted earnings per share of $1.06, far exceeding analysts’ estimate of $0.62, on revenue of $17.7 billion, beating the consensus of $14.95 billion.

Pfizer’s results were driven by a surge in sales of its COVID-19 antiviral Paxlovid, which climbed to $2.7 billion from $200 million a year ago amid a recent global COVID wave.

The company also saw robust growth in its oncology division, particularly from Seagen’s legacy products, which contributed $854 million to Q3 sales following Pfizer’s $43 billion acquisition of Seagen last December.

Sales of heart-disease drugs in the Vyndaqel group also rose by 63%.

Pfizer raised its full-year guidance, now projecting revenue between $61 billion and $64 billion and adjusted EPS between $2.75 and $2.95, up from prior estimates of $59.5 billion to $62.5 billion and EPS of $2.45 to $2.65.

CEO Albert Bourla highlighted Pfizer’s “exceptional growth” in oncology and strong response to heightened demand for Paxlovid, underscoring the strength of its current portfolio.

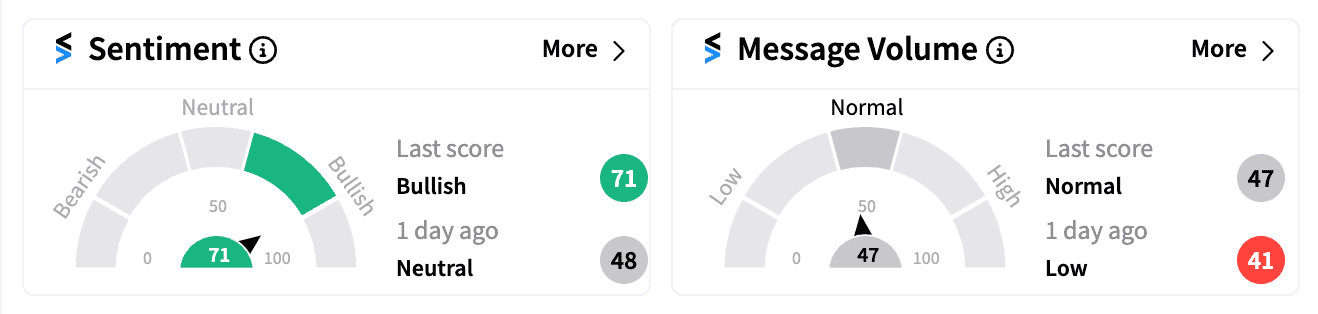

Retail sentiment on Stocktwits turned ‘bullish’ (71/100) on Tuesday, with message volume also seeing an uptick.

However, Pfizer’s performance has drawn scrutiny from activist investor Jeff Smith of Starboard Value, which recently took a $1 billion stake in the company.

Smith has criticized Pfizer’s strategies under Bourla, including overspending on acquisitions and weak returns on R&D, which he claims led to at least $20 billion in value erosion, according to Bloomberg.

At a recent conference, Smith reportedly suggested it “could make sense” for Pfizer to consider a leadership change.

While Pfizer’s stock surged to around $59 in 2021 during the pandemic’s peak, driven by its COVID-19 vaccine success, shares have since fallen over 50% as pandemic-related revenues dwindled.

Year-to-date, PFE stock has inched up 0.2%, lagging behind the broader S&P 500’s 22% gain.

For updates and corrections, email newsroom@stocktwits.com

Read next: SoFi Stock Jumps As CEO Hails 'Strongest Quarter In Our History': Retail Confidence Grows

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)