Advertisement|Remove ads.

P&G Stock Gets A Downgrade, Price Target Cut As Evercore ISI Sees Challenging Retail Shift

Evercore ISI downgraded Procter & Gamble (PG) to ‘In-line’ from ‘Outperform’ on Monday, noting that the adverse shifts in the retail channel challenge Procter's growth potential.

The brokerage also reduced P&G’s price target to $170 from $190, according to TheFly. P&G’s shares fell 1.6% to $154.43 during early trading on Monday.

The biggest obstacle currently for Procter & Gamble comes from consumers increasingly buying more goods from Amazon, Evercore noted, according to a CNBC report. The shift to Amazon could limit the company’s sales growth to below 4%, a level necessary to drive operating leverage, the brokerage said.

The report added that although the company is performing well at traditional retailers such as Walmart and Costco, Evercore ISI’s research indicates relative share losses on Amazon.

In June, the Tide detergent maker said it plans to eliminate 7,000 jobs over the next two years as it navigates a slowing and uncertain consumer spending climate, which is currently pressured by U.S. President Donald Trump’s tariffs.

The on-and-off tariffs imposed by Trump have resulted in low consumer confidence, with most shoppers now prioritizing spending on essentials and switching to private label brands to save money.

P&G, in April, said it would have to hike prices on some of its products to counter the rising costs tied to the tariffs and had lowered its annual forecasts, as customers pare back spending on its household and personal care items.

The company is set to report fourth-quarter earnings on July 29. P&G is expected to post net sales of $20.80 billion and adjusted profit of $1.43 per share, according to data compiled by FinChat.

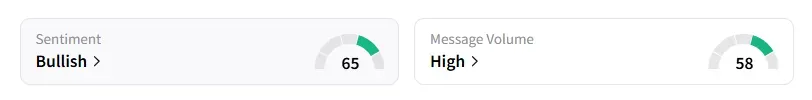

Retail sentiment on P&G improved to ‘bullish’ from ‘neutral’ a day ago, while message volume remained high.

P&G shares have declined by over 8% year-to-date and roughly 7% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Starbucks Gets Price Target Raise From Citi, But Retail’s Not Excited Yet

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)