Advertisement|Remove ads.

Philip Morris’ Strong Smoke-Free Products Demand Ignites Retail Hype

Philip Morris (PM) CEO Jacek Olczak said on Tuesday that the company has experienced strong momentum across its diversified smoke-free portfolio, primarily driven by increased IQOS sales growth and off-take growth for ZYN in the U.S.

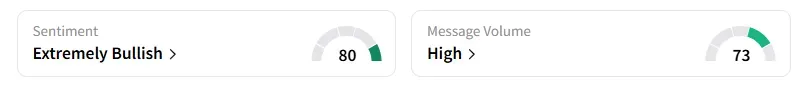

The retail user message count on Philip Morris jumped over 1000% in the last 24 hours on Stocktwits, with retail sentiment on the stock improving to ‘extremely bullish’ from ‘neutral’ a day ago amid ‘high’ levels of chatter.

The Marlboro maker said smoke-free business accounted for 41% of total net revenues in the second quarter (Q2).

Philip Morris shares were down nearly 6% in premarket trading after the company slightly missed quarterly revenue expectations.

Shipment volume for cigarettes fell 1.5% in the quarter, but Olczak added that the steady growth in the smoke-free category, coupled with the resilience of combustibles, helped the company raise its annual profit forecast.

Philip Morris now expects full-year 2025 adjusted profit to be between $7.43 and $7.56 per share, compared with the previous expectation of $7.36 to $7.49.

The company reported that shipment volume for oral smoke-free products increased by 23.8% in pouches or pouch equivalents, driven by nicotine pouches, which more than doubled outside the U.S. and the Nordics, and in the U.S. , grew by over 40% to 190 million cans.

Philip Morris’ Q2 revenue jumped 7.1% to $10.14 billion, compared with Wall Street expectations of $10.33 billion, according to data compiled by Fiscal AI.

The company’s adjusted profit came in at $1.91 per share, beating estimates of $1.86.

Philip Morris stock has gained nearly 50% year-to-date and has increased by 65% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)