Advertisement|Remove ads.

Phillips 66 Stock In Spotlight After Boardroom Battle With Elliott Ends In A Tie: Retail’s Bearish

Phillips 66 (PSX) stock drew retail attention on Wednesday after preliminary results indicated that the company and the activist investor Elliott Investment Management won two seats each at the oil refiner's annual shareholder meeting.

After a widely followed boardroom battle, Phillips 66 shareholders elected former ConocoPhillips Chief Financial Officer Sigmund Cornelius and former Targa Resources executive Michael Heim among Elliott’s nominees.

The oil refiner’s nominees, Robert Pease, whom the company had added with Elliott’s nod last year, and Nigel Hearne, were also elected.

“Today's vote sends a clear message: shareholders demand meaningful change at Phillips 66,” Elliott said in a statement.

Phillips 66's stock fell 7.5% on Wednesday following the mixed results.

This was the first time that the highly active hedge fund fought in a board election at a U.S. company to push for changes. Proxy advisors Institutional Shareholder Services and Glass Lewis had backed four and three of Elliott’s nominees, respectively, earlier in May.

“Phillips 66’s split election with Elliott on four board seats indicates shareholders want a measured approach to altering the company’s integrated structure,” a report said, citing Bloomberg Intelligence analyst Brett Gibbs.

Elliott built a $2.5 billion stake in Phillips 66 earlier this year, making it a top-five shareholder in the company.

It is pushing for a strategic shift at Phillips 66, including selling its midstream business and the stake in a chemical joint venture with Chevron.

However, Phillips 66 has said its pipelines are an essential part of the business, and there would be adverse consequences, including a high tax burden, if there were a spinoff.

“This vote reflects a belief in our integrated strategy and a recognition that our early results do not yet reflect the full potential of our plan or the value inherent in this business,” Phillips 66 CEO Mark Lashier said.

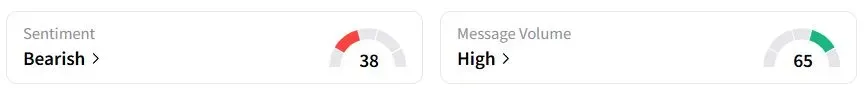

Retail sentiment on Stocktwits was in the ‘bearish’ (38/100) territory, while retail chatter was ‘high.’

“It will be interesting to see how this plays out,” one retail trader said.

Reuters reported, citing sources, that institutional investors BlackRock, State Street, and Vanguard had all voted in favor of the management’s nominees.

Phillips 66 stock has fallen 2.6% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)