Advertisement|Remove ads.

Phoenix Mills Shares: SEBI RA Vinayak Gautam Sees Buying Opportunity After Strong Q1 Retail Sales

Phoenix Mills shares rose 2% on Tuesday as the street digested the company's first-quarter (Q1) operational update, which showed strong growth across both retail and residential segments.

SEBI-registered analyst Vinayak Gautam highlighted that the company’s retail sales (consumption) across all operational malls rose by 12% year-on-year in the first quarter of FY26, indicating strong underlying demand and sustained momentum across its portfolio. Growth was driven by key malls like Phoenix Palassio, Phoenix Citadel, Phoenix Palladium, and Palladium Ahmedabad, and supported by the continued ramp-up of their new assets, such as Phoenix Mall of the Millennium and Phoenix Mall of Asia.

Trading occupancy for the quarter stood at 89%, slightly down from 91% in Q4 FY25, mainly due to planned transitional vacancies associated with ongoing upgrades.

Gautam suggested buying Phoenix stock at ₹1,549, with a stop loss of ₹1,535 and a target price of ₹1,580, over a one-week timeframe.

https://stocktwits.com/Wisebull_co_in/message/620145401

Gross residential sales of around ₹168 crore were recorded in Q1, compared to ₹50 crore in the same quarter a year ago (YoY), and collections of ₹99 crore.

On the commercial side, gross leasing of nearly 4.07 lakh square feet was completed during Q1FY26 across the assets in Mumbai, Pune, Bangalore, and Chennai. Occupancy in the operational assets at Mumbai and Viman Nagar in Pune stood at 69% in June 2025, compared to 67% in March 2025.

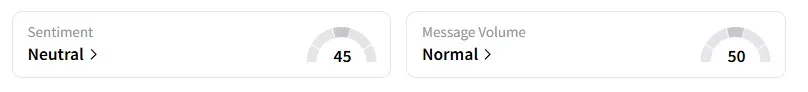

Data on Stocktwits shows that retail sentiment has remained ‘neutral’ on this counter for over a month now.

Phoenix Mills shares have fallen 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)