Advertisement|Remove ads.

India Market Watch: Positive Start For Nifty, Sensex — Pharma Stocks Rally

Indian equity benchmarks opened in the green on Wednesday, led by a sustained rally in pharmaceutical and healthcare stocks.

By 9:40 a.m. IST, the Nifty 50 rose 133 points to 24,817, while the Sensex gained 444 points to 81,631, recovering from Tuesday's losses.

Broader markets bounced back; the Nifty Midcap index traded with marginal gains in early trade.

Nearly all sectoral indices were trading higher, with pharma stocks rallying for the second consecutive session.

Sun Pharma, Dr. Reddy's, Cipla, and Apollo Hospitals posted early gains between 2% and 3%, as investor interest continued to build in defensive names.

Torrent Pharma surged 4% after reporting strong March quarter results, prompting Citi to maintain a ‘Buy’ call with a ₹4,000 target price, implying a 23% upside.

Other notable earnings movers included Whirlpool (+2%), Gland Pharma (+3%), and Bharat Electronics (BEL), which rose over 3% after upbeat FY26 guidance.

BEL is now the top Nifty gainer, with brokerages raising price targets. Macquarie has rated the stock ‘Outperform’ with a target of ₹400, implying a 10% potential upside.

In contrast, Dixon Technologies fell 7% despite a steady Q4 showing.

KPR Mill dropped 6% after a block deal involving 3.2% of its equity.

Eternal continued to see selling pressure, down 1%, amid lingering MSCI inclusion overhang concerns.

Investors will monitor ONGC, IndusInd Bank, Colgate, Indigo, IRCON, NALCO, PFC, VA Tech Wabag, and RVNL as they report quarterly numbers later in the day.

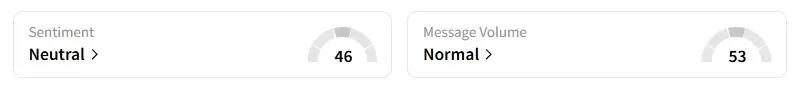

Meanwhile, retail sentiment on Stocktwits for the Nifty 50 has turned ‘neutral’ from ‘bullish’ yesterday.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged immediate support for the Nifty at 24,495 and resistance at 24,920 and 25,020, while he placed Bank Nifty support at 54,442 and resistance at 55,300 and 55,600.

A&Y Market Research sees Nifty (intraday) support between 24,455 - 24,507 with resistance at 24,746 - 24,811. For the Bank Nifty, they peg resistance at 55,443 - 55,557 and support at 54,334 - 54,470.

Ashish Kyal highlights that the Nifty 50 has been steadily drifting lower since reaching the 25,060 level, without registering any hourly candle close above the previous high, underscoring the prevailing weakness in the index.

Kyal said a 15-minute close above 24,810 is essential for a potential recovery toward 24,930.

Conversely, selling pressure will likely intensify if the index falls below 24,640, potentially pushing the Nifty down to 24,550 in the short term. He currently sees the broader trading range as 24,550–24,810.

Asian markets traded mixed as investors parsed reports of escalating tensions between Israel and Iran and the stalled progress on new trade agreements. Japanese stocks declined due to weak trade data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)