Advertisement|Remove ads.

Prestige Estates Rallies On Record Sales; Bullish Chart Pattern Signals More Gains

Prestige Estates shares surged nearly 6% intraday on Thursday after the company reported robust sales for the second quarter (Q2) in an operational business update.

The real estate company reported a 50% year-on-year jump in Q2 sales bookings to ₹6,017 crore. Its total H1FY26 sales soared 157% year-on-year to ₹18,144 crore, and exceeded the full-year FY25 sales in just six months.

Housing demand across markets drove this strong performance for Prestige, especially Bengaluru, which alone contributed 40% of Q2 sales volume.

Q2 sales volume stood at 4.42 million square feet, with increased realizations for apartments and plots. Collections also rose sharply, up 54% YoY in Q2 and H1.

In the second quarter, Prestige Estates launched 3.87 million sq ft, contributing to a total of 18.81 million sq ft in the first half. Office leasing reached 2.3 million sq ft in Q2, while retail turnover saw a 9% year-over-year increase, reaching ₹6,236 million.

Technical Outlook

SEBI-registered analyst Prabhat Mittal noted the formation of an inverse head and shoulder pattern on its charts, which is a bullish pattern. On the downside, Prestige Estates stock is taking support around ₹1,490, which is seen as a crucial level of support.

Mittal said that the stock was currently trading above the 200-day moving average (DMA) and had crossed the 20-DMA, which is also considered a positive signal.

He advised traders to buy Prestige Estates at the current price of ₹1,563, with a strict stop-loss below ₹1,460, for a target price of ₹1,750 and ₹1,800.

https://stocktwits.com/prabhatmittal1/message/631607594

What Is The Retail Mood?

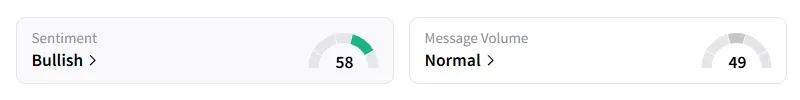

Data on Stocktwits indicates that retail sentiment shifted to ‘bullish’ following the strong quarterly update. It was ‘neutral’ last week.

Prestige Estate shares have declined 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_crash_490d43331a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dominos_resized_jpg_f70082df7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1198350622_jpg_c4fc77e19d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_merck_logo_resized_05f46cfc54.jpg)