Advertisement|Remove ads.

Papa John’s Stock Rises, Retail Buzz Grows As Analyst Note Sparks Takeover Speculations

Shares of Papa John’s International, Inc. (PZZA) surged more than 5% on Monday, with retail sentiment also climbing, fueled by rumors of a potential takeover.

The speculation began to gain traction after Don Bilson, head of event-driven research at Gordon Haskett, highlighted a development involving 3G Capital, a major investor in Restaurant Brands (QSR).

Bilson noted that 3G Capital, the buyout firm founded by Brazilian billionaire Jorge Paulo Lemann, played a key role in Restaurant Brands’ acquisition of Tim Hortons a decade ago. Since then, Restaurant Brands has expanded its portfolio by acquiring Popeyes for chicken and Firehouse Subs for sandwiches, but it has yet to enter the pizza market.

"Our interest was mildly piqued when we saw a 3G jet make a trip to Louisville on August 15. That city, of course, is the home of Papa John's," Bilson said in a note to investors.

This observation has fueled speculation that Restaurant Brands might be eyeing Papa John’s as its next acquisition target.

A Papa John’s spokesperson told Stocktwits the company does not “comment on rumors or speculation.”

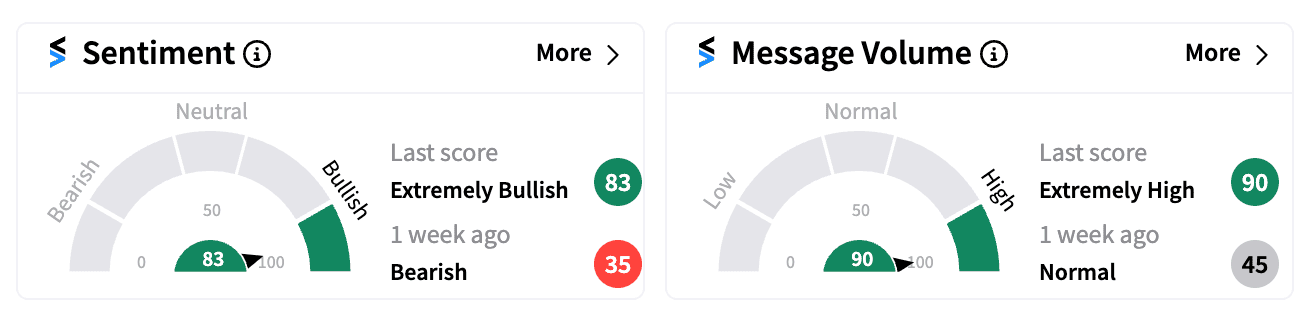

Despite the lack of official confirmation, retail investors appear to have taken notice. On Stocktwits, sentiment for PZZA turned 'extremely bullish,' with message volume surging to 'extremely high' levels as the rumors gained momentum.

The potential acquisition of Papa John’s by Restaurant Brands would align with its strategy of diversifying its fast-food offerings, especially in light of the success of its fast-food rival Yum Brands (YUM) owning Taco Bell, Pizza Hut and KFC.

Last week, Wedbush Securities maintained an ‘Outperform’ rating and a $51 price target on the stock, expressing confidence in the new CEO, Todd Penegor, who previously led a successful turnaround at Wendy’s.

However, other analysts have taken a more cautious stance. BMO Capital, Piper Sandler, and KeyBanc have all lowered their price targets on Papa John’s, citing a challenging sales environment.

Earlier this month, Papa John’s reported a 1.3% year-over-year decline in Q2 sales to $507.9 million that missed Wall Street estimates.

However, adjusted earnings per share of $0.61 cents exceeded expectations.

The company also reported a 4% decline in North American comparable sales, flat international comparable sales, and 31 net unit closures, including 43 company-owned restaurants in the U.K.

These challenges have contributed to a more than 35% drop in PZZA stock this year as the chain struggles to maintain demand amid a high-inflation environment where many quick-service restaurants are competing fiercely on price. Shares of the company were up slightly in Tuesday pre-market trading.

Read Next: Quantum Biopharma Stock (QNTM) Sees Retail Following Skyrocket Over 2,500% In A Week

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)