Advertisement|Remove ads.

Qualys Q4 Beats Estimates But Guidance Disappoints: Retail Sentiment Nosedives As Stock Plunges

Qualys, Inc. (QLYS) shares declined in Thursday’s extended trading after the Foster City, California-based company’s fiscal year 2025 bottom-line guidance trailed expectations.

The cloud-based platform provider of IT, security, and compliance solutions reported fourth-quarter non-GAAP earnings per share (EPS) of $1.60 on revenue of $159.2 million, up 10% year over year.

The top- and bottom-line results exceeded the average analysts’ estimates, which called for EPS and revenue of $1.37 and $156.21 million, respectively, and the company’s guidance issued in early November.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) climbed 13% to $74.2 million, and adjusted EBITDA margin expanded a percentage point to 47%.

Sumedh Thakar, CEO said, "Our results this quarter demonstrate the rapid pace of innovation at Qualys and reflect the growing success of newer product initiatives, including Cybersecurity Asset Management, Patch Management, and TotalCloud.”

He noted that customers are starting to leverage the breadth and depth of the Qualys Enterprise TruRisk Platform.

Qualys guided first-quarter non-GAAP EPS to $1.40-$1.50 and revenue to $155.5 million—$158.5 million, encompassing the $1.48 and $157.67-million consensus estimates.

The full-year outlook envisages non-GAAP EPS of $5.50-$5.90 and revenue of $645 million—$657 million. The bottom-line outlook trailed the consensus estimates of $6.13 but revenue guidance was surrounded the consensus of $649.83 million.

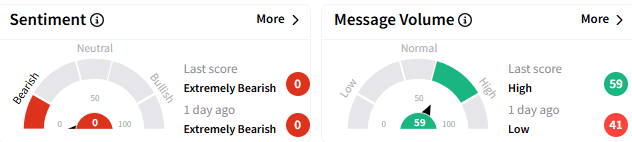

On Stocktwits, sentiment toward Qualys stock stayed ‘extremely bearish’ (0/100), but message volume rose to ‘high’ due to the increase in trader chatter amid the quarterly print.

A platform user said the stock could drop further due to the sub-par guidance.

https://stocktwits.com/Shortbreaker9000/message/587962093

In Thursday’s after-hours session, the stock shed 5.60% to $132.83. The stock has changed very little for the year-to-date period after declining nearly 29% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)