Advertisement|Remove ads.

Will Rail Vikas Nigam Limited Shares Rally More? SEBI RA Gaurav Narendra Puri Sets 3 Upside Targets

Rail Vikas Nigam Limited (RVNL) shares are poised for upside, according to SEBI-registered analyst Gaurav Narendra Puri.

With the current market price (CMP) at ₹410, Puri has set target prices at ₹435, ₹460, and ₹480 over a one-month horizon, recommending a stop-loss at ₹390.

At the time of writing, RVNL shares were trading at ₹406.40, down 1.37% or ₹5.65.

Fundamentally, RVNL demonstrates strength with a rising book value over the past three years, a solid return on equity of 15.13%, and consistently increasing EBITDA and annual net profit.

The promoter holding stands at a healthy 72.8%, adding confidence to the stock’s outlook.

From a technical standpoint, the stock shows bullish momentum with a relative strength index (RSI) above 60 and strong support at the 20-day exponential moving average (EMA).

Price action indicates support levels visible on charts, and RVNL has exhibited notable strength and volume in the last four trading sessions.

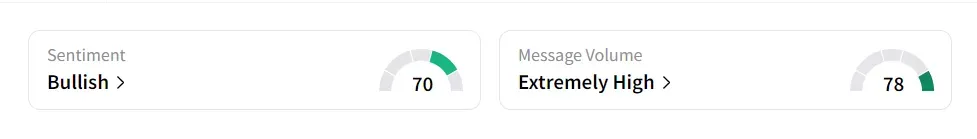

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘extremely high’ message volume.

The stock has declined 5.1% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_logal_paul_OG_jpg_3c5ff1734b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corsair_gaming_jpg_f2eebff8d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)