Advertisement|Remove ads.

Monday Movers: These Four Stocks Surge On Fresh Order Wins

Strong action in the midcap and smallcap space as shares of Engineers India, Shakti Pumps, RailTel, and Ceigall gained between 3% and 7% on Monday after bagging key contracts over the weekend.

Let’s take a look at what’s driving this rally for these stocks

Engineers India (EIL)

The company won an international contract worth about ₹618 crore to provide PMC and EPCM services for a new fertilizer plant in Africa. The 24-month project, awarded by an African fertilizer company, covers end-to-end consultancy and engineering support for setting up the facility.

EIL stock gained as much as 4.35% to ₹217.90 in early trade, having gained 17% so far this year.

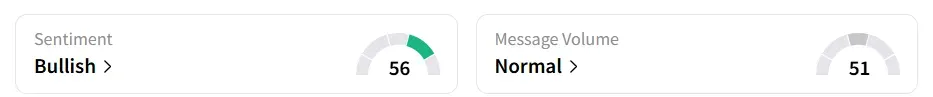

Retail sentiment for Engineers India turned ‘bullish’ on Stocktwits. It was ‘neutral’ a week earlier.

RailTel Corporation of India

The railway company received a Letter of Acceptance (LOA) from the Bihar Education Project Council (BEPC) for a domestic order valued at ₹209.78 crore.

The contract is for the implementation of education quality enhancement initiatives in Bihar. The project primarily involves supply-related work and is scheduled to be executed by September 11, 2026.

RailTel’s shares surged 7.45% to ₹407.4. The stock has fallen around 0.3% year-to-date (YTD).

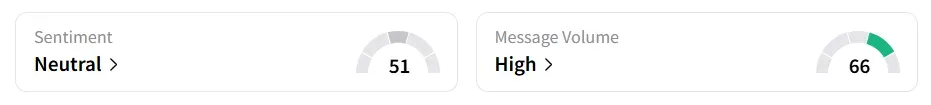

Retail sentiment shifted to ‘neutral’ from ‘bearish’ a week earlier on Stocktwits. Chatter was ‘high’ on the platform.

Shakti Pumps (India)

This Indian pump company received a Letter of Empanelment for 34,720 off-grid solar water pumps. The first tranche of 10,000 pumps was worth ₹268.88 crore, followed by a second tranche of 12,451 pumps worth ₹347.41 crore, taking total orders to ₹616.30 crore.

Shakti Pumps’ shares gained as much as 6.7% to ₹914.45, having shed 16.8% YTD.

Analyst Call: According to SEBI-registered analyst Prabhat Mittal, the stock, after hitting an all-time high of ₹1,387 on January 9, corrected sharply to a low of ₹755 on March 4. Since then, the stock has been consolidating in a range between ₹750 and ₹1,000, according to short-term charts.

In the last two sessions, the stock crossed its 20-day, 50-day, and 10-day moving averages and touched levels near the 200 DMA, Mittal noted. However, considering it was trading below all key averages just a few days ago, fresh buying at higher levels appears risky.

He recommends fresh entries around ₹820 - ₹825 or near trendline support, with a strict stop-loss below ₹750, and a target of ₹1,050.

Ceigall India

This small-cap stock rose 3.3% to ₹278.2 after the company secured a ₹509.20 crore contract from the Greater Mohali Area Development Authority (GMADA) for developing and constructing internal road networks in Pockets B, C, and D of Aerotropolis City, S.A.S. Nagar.

The project, which includes road infrastructure, public health services, and electrical installations, will be executed over 24 months with a 36-month defects liability period.

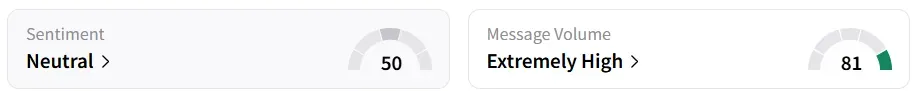

Retail chatter on Stocktwits was ‘extremely high’ despite sentiment remaining ‘neutral’.

Ceigall’s shares have fallen 17% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)