Advertisement|Remove ads.

Rajiv Anand outlines four-step plan to rebuild IndusInd Bank & restore investor confidence

IndusInd Bank MD & CEO Rajiv Anand shares his vision to restore investor confidence, rebuild the bank, and drive growth after a challenging year marked by a 45% decline in shares.

Forty-five days into his tenure as MD & CEO of IndusInd Bank, Rajiv Anand has already laid out a clear vision for reviving the lender after a turbulent period. Anand highlighted the foundations of the bank as strong and shared his priorities: rebuilding trust with stakeholders, regaining business momentum, building a profitable and balanced franchise, and unlocking productivity through fintech innovations.

He emphasised a gradual, three-stage approach: first, restoring the bank’s internal and external credibility; second, regaining market share; and third, achieving industry leadership. While it’s still early days, Anand is confident that IndusInd Bank will emerge as a substantially stronger bank over the next few years.

IndusInd Bank currently has a market capitalisation of approximately ₹58,270.99 crore. Over the past year, its shares have fallen nearly 45%.

Below are the edited excerpts from the interview.

Q: Your first observations after taking charge as MD & CEO of IndusInd Bank, especially given the troubled waters the bank has been through?

A: I am absolutely delighted to have taken over IndusInd Bank. Yes, it’s been a bit of a checkered past, but my first impression in these 45 days is that the foundations of this bank are strong. I do believe that we can build a strong bank that our customers, regulators, promoters, and investors will be proud of.

Q: What will be the priorities as you look to regain investor confidence and rebuild the bank? What are some of the challenges you’ve identified and the opportunities you plan to work on?

A: There are four key priorities. First, as you rightly said, building trust—with regulators, investors, depositors, and most importantly, our employees. Second, regaining business momentum is a bit slower at this point. We put out our balance sheet numbers a couple of days ago. Third, starting to build a profitable franchise that’s more balanced on both the liabilities and asset sides. And finally, since we are here at the Global Fintech Fest, there’s so much we can do to unlock productivity for the bank. I am here to learn what we can adopt from the Global Fintech Fest for IndusInd Bank.

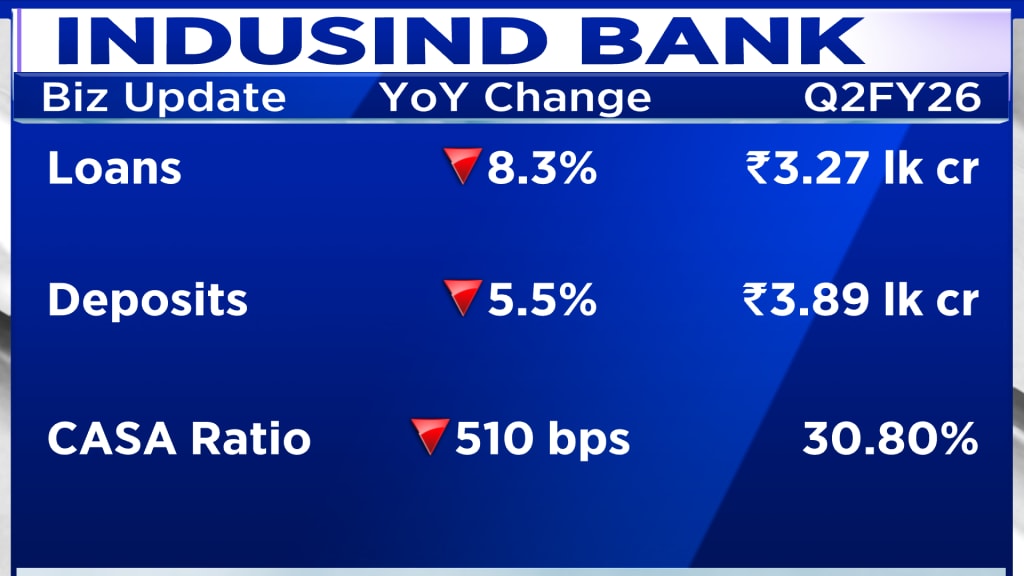

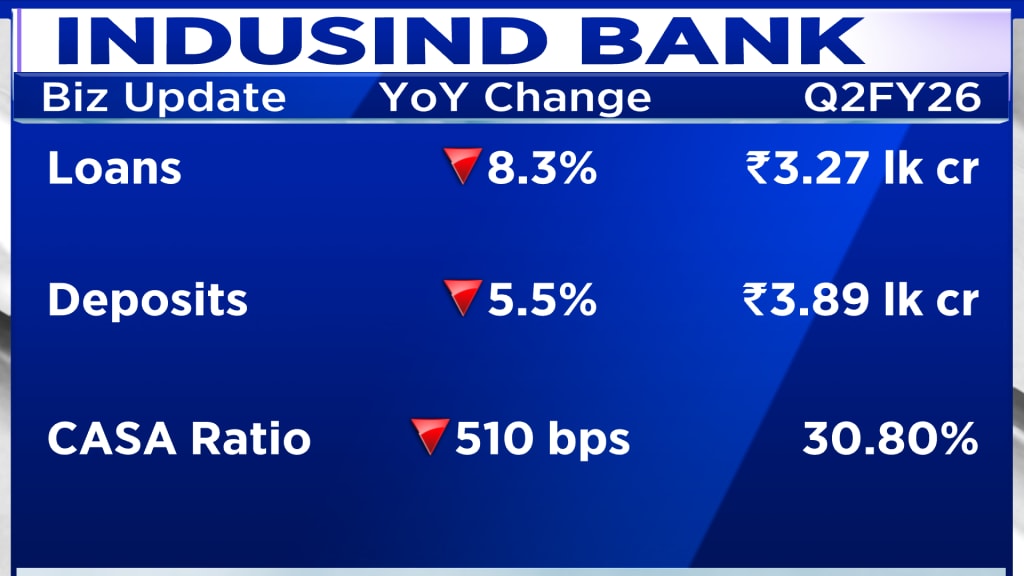

Q: Speaking about business momentum and the numbers you have just disclosed, this is a stark contrast to most other banks we’ve seen, with an 8% decline in advances and a 5% decline in deposits. When do you think this could meaningfully turn around, given what the bank is going through?

A: We are currently in a silent period as results are expected on the 18th. But progress is something we’ll need to make steadily. One of the things we’re working on right now is rebuilding the leadership team. You’ve seen that we have a new CFO, a new legal head, a new marketing head, a new internal audit head, and so on. You’ll see more people joining between now and March 31. As the team comes together, these individuals will help transform the bank. Over three years, I believe IndusInd Bank will regain its preeminent status within the banking industry.

Also Read: IndusInd Bank shares in focus after Q2 update bucks the otherwise strong banking trend

Q: So, will it take three years to regain the lost ground, given the recent lapses?

A: I think it’s a matter of process. I don’t want to overpromise that everything will turn around immediately. Stage one will be about rebuilding the bank and regaining business momentum. Stage two will focus on gaining market share, and stage three will be about domination. So, it’s not that we’ll have to wait the full three years, but it will be a gradual process, and I do believe we’ll be a substantially better bank within that timeframe.

Q: In three years, you’re talking about achieving domination. So, is it safe to say that within two years the bank could be back to the kind of growth and profitability we saw before these lapses came to light?

A: Early days, and I promise to have a more detailed conversation with you in the months to come. Like you rightly said, it’s been just 45 days since I joined the bank. So, I promise you a longer conversation soon — on our strategy, growth aspirations, and what we aim to achieve in the coming months.

Q: Speaking of rebuilding the top team, there has been a speed of appointments that you spoke about, internal audit, new CFO and so on. What next in this process, if you sort of rebuild the bank after the series of lapses that have come to light, what are the new appointments we should look forward to, and what would you want to guide the investors in terms of the rebuilding process itself?

A: Some senior team retirements are coming up over the next 6 months or so. So, we will have to replace those, and you will hear about some of those. Currently, many of these conversations are with me, and you will hear about that in the months to come.

Q: Coming back to the business momentum, given that there has been a decline in this quarter with the GST cuts that have come in, in the initial phase of September, for instance, have you started to see any kind of uptick? Will there be a meaningful revision to whatever you're expecting the credit growth for the year to be, thanks to these cuts?

A: There are 3-4 things that have happened; I mean, liquidity is much easier. There is a transmission of rates that is playing out, the tax cuts that have been implemented are now percolating into the system and finally, of course, goods and services tax (GST). Therefore, I do believe that newspaper headlines are saying that, as well as that we are certainly seeing demand is much better at this point. Some of it is pent up, but I do believe that the second half of the year will be significantly better than the first half of the year. And that should, by definition, then convert into better loan growth, particularly on the retail side, better transaction flows on our credit card business and so and so on.

Q: In terms of the pockets of stress because of the tariff-exposed sectors, what is the total exposure of the bank to these sectors that might be affected? And are you already starting to build in those provisions, or are you seeing some sort of a turnaround also in sectors like microfinance institutions (MFI), micro, small & medium enterprises (MSME), which had been seeing a period of stress before?

A: We have done some work around this, particularly around our gems and jewellery business. We are quite comfortable in terms of the exposures that we are currently carrying. It is to better-rated corporates or the market leaders within that space. Second, on MFI, the general commentary is that the second half of the year will certainly be much better than where we are today, and that should play positively for us. We have a very large commercial vehicle business, and the GST cuts should play positively for that business as well.

Also Read: IndusInd Bank reports 8% decline in net advances, deposits fall 5% in Q2

Q: To close this loop on IndusInd Bank 2.0, what will be the key growth engines from hereon, and how do you get back to being among the top 3, top 4 banks? I mean, what is the pathway glide path to that?

A: One, there is work that we need to do on the liability side, such that we can bring our cost of deposits down. Two, on the asset side, we need to broaden the base of our offerings to our customers, which will, in a sense, play to the liability franchise as well, and third is to continue to strengthen some of the key businesses or domains that we have always been strong on commercial vehicles, gems and jewellery and microfinance.

Q: On the corporate side, especially given the spate of regulation reforms we have seen from the Reserve Bank of India, how much additional headroom do you think there is for credit getting unlocked, especially when it comes to capital market financing and merger and acquisition (M&A) financing?

A: I think some of the things that the RBI has done this time are seminal in that sense. Many of these things are things that the banks have been asking for, particularly M&A financing. And what RBI has put out there is truly transformational, but at the same time, it addresses the supply side. But I still worry about the amount of demand that we will have for credit, particularly from the corporate side, because they continue to be delivered, they continue to generate strong cash flow, and they have access to equity markets. And we are currently seeing 2 large IPOs in the market as we speak. Therefore, to that extent, their requirement from the banking sector at this point is expected to be relatively muted. One will have to watch out whether some of that ECB demand, etc., moves from the ECB onto local balance sheets, but still early days.

Q: Overall, you think the tone of these reforms in this regulation overhaul that we have seen from RBI, 22 announcements in one policy. What does that indicate to you, I mean, is this that the banking system is mature, and so some of these tight guard ways that the RBI had built around these systems can be let loose? Or are you worried, it could lead to some risk build-up as well if a lot of it is left to the bank’s discretion?

A: I think it clearly shows RBI’s intent to unlock the potential for the banking industry. And many of these reforms are really going to help in terms of ease of doing business, our ability to help work with our clients in a much better manner. And so, therefore, it just signals the intent of the regulator to make banking simple in this country.

Q: But you think corporate growth, which has been stalled because of the reasons you outlined as well, could get a meaningful uptick, especially with this large corporate total exposure, etc., getting revised or being scrapped altogether, rather?

A: I think those are enablers. One has to see the demand side. Just going back to your previous question on demand. I think if consumption starts to grow, it is a matter of time before private CapEx begins to kick in. And then once that starts to happen, I am sure there will be demand from corporates both on the working capital side as well as for term loans.

Q: Even on the ECL front, the expected credit loss adoption, which has been talked about for many years now, the RBI is talking about 2027 and another 5-year glide path for banks to adopt that. That gives you plenty of time to absorb any sort of additional provisioning that may be available.

A: If you look at the banking industry, various banks are at various stages of evolution as far as ECL is concerned. I think some of the larger private banks are much closer to adoption, while some of the other banks may be…and so therefore, to that extent, the fact that RBI has put out a roadmap, a glidepath for this. First and foremost, it takes the uncertainty out of…and we have been talking about when ECL is going to come for the last 4 or 5 years. So, at least to that extent, that is now out. And you will see various banks, there will be early adopters, and there will be banks that will use the full 4 years.

Also Read: CRED partners with ixigo for flight bookings on its newly launched IndusInd Bank RuPay Credit Card

Q: Speaking of capital, there is a board approval in place now for you to raise capital. How soon before we see IndusInd Bank raising equity? Take us through the timelines and the deployment of that for various purposes.

A: The resolution is just an enabling resolution. But if you look at the numbers from a capital adequacy perspective, we are well above 16%. Common Equity Tier 1 (CET1) is well above 15%. So, at this point, IndusInd Bank doesn't require capital.

Q: So, you might not be raising that capital at all.

A: I do not see us raising capital, at least in the short term.

Q: What is the next big thing to watch out for from IndusInd Bank in 2026 as you steady the ship and rebuild the bank? What is the one big theme to watch out for?

A: It is the rebuilding of trust; like I mentioned to you, everything that we do has to ensure that we once again become the trusted partner and a partner that our customers will repose faith in, the regulators are we are comfortable with our business model and the ethical standards that we are working with. Investors get comfortable in terms of disclosures, and the media is once again more favourably disposed towards IndusInd Bank.

Watch the interview in the accompanying video

Catch all the latest updates from the stock market here

He emphasised a gradual, three-stage approach: first, restoring the bank’s internal and external credibility; second, regaining market share; and third, achieving industry leadership. While it’s still early days, Anand is confident that IndusInd Bank will emerge as a substantially stronger bank over the next few years.

IndusInd Bank currently has a market capitalisation of approximately ₹58,270.99 crore. Over the past year, its shares have fallen nearly 45%.

Below are the edited excerpts from the interview.

Q: Your first observations after taking charge as MD & CEO of IndusInd Bank, especially given the troubled waters the bank has been through?

A: I am absolutely delighted to have taken over IndusInd Bank. Yes, it’s been a bit of a checkered past, but my first impression in these 45 days is that the foundations of this bank are strong. I do believe that we can build a strong bank that our customers, regulators, promoters, and investors will be proud of.

Q: What will be the priorities as you look to regain investor confidence and rebuild the bank? What are some of the challenges you’ve identified and the opportunities you plan to work on?

A: There are four key priorities. First, as you rightly said, building trust—with regulators, investors, depositors, and most importantly, our employees. Second, regaining business momentum is a bit slower at this point. We put out our balance sheet numbers a couple of days ago. Third, starting to build a profitable franchise that’s more balanced on both the liabilities and asset sides. And finally, since we are here at the Global Fintech Fest, there’s so much we can do to unlock productivity for the bank. I am here to learn what we can adopt from the Global Fintech Fest for IndusInd Bank.

Q: Speaking about business momentum and the numbers you have just disclosed, this is a stark contrast to most other banks we’ve seen, with an 8% decline in advances and a 5% decline in deposits. When do you think this could meaningfully turn around, given what the bank is going through?

A: We are currently in a silent period as results are expected on the 18th. But progress is something we’ll need to make steadily. One of the things we’re working on right now is rebuilding the leadership team. You’ve seen that we have a new CFO, a new legal head, a new marketing head, a new internal audit head, and so on. You’ll see more people joining between now and March 31. As the team comes together, these individuals will help transform the bank. Over three years, I believe IndusInd Bank will regain its preeminent status within the banking industry.

Also Read: IndusInd Bank shares in focus after Q2 update bucks the otherwise strong banking trend

Q: So, will it take three years to regain the lost ground, given the recent lapses?

A: I think it’s a matter of process. I don’t want to overpromise that everything will turn around immediately. Stage one will be about rebuilding the bank and regaining business momentum. Stage two will focus on gaining market share, and stage three will be about domination. So, it’s not that we’ll have to wait the full three years, but it will be a gradual process, and I do believe we’ll be a substantially better bank within that timeframe.

Q: In three years, you’re talking about achieving domination. So, is it safe to say that within two years the bank could be back to the kind of growth and profitability we saw before these lapses came to light?

A: Early days, and I promise to have a more detailed conversation with you in the months to come. Like you rightly said, it’s been just 45 days since I joined the bank. So, I promise you a longer conversation soon — on our strategy, growth aspirations, and what we aim to achieve in the coming months.

Q: Speaking of rebuilding the top team, there has been a speed of appointments that you spoke about, internal audit, new CFO and so on. What next in this process, if you sort of rebuild the bank after the series of lapses that have come to light, what are the new appointments we should look forward to, and what would you want to guide the investors in terms of the rebuilding process itself?

A: Some senior team retirements are coming up over the next 6 months or so. So, we will have to replace those, and you will hear about some of those. Currently, many of these conversations are with me, and you will hear about that in the months to come.

Q: Coming back to the business momentum, given that there has been a decline in this quarter with the GST cuts that have come in, in the initial phase of September, for instance, have you started to see any kind of uptick? Will there be a meaningful revision to whatever you're expecting the credit growth for the year to be, thanks to these cuts?

A: There are 3-4 things that have happened; I mean, liquidity is much easier. There is a transmission of rates that is playing out, the tax cuts that have been implemented are now percolating into the system and finally, of course, goods and services tax (GST). Therefore, I do believe that newspaper headlines are saying that, as well as that we are certainly seeing demand is much better at this point. Some of it is pent up, but I do believe that the second half of the year will be significantly better than the first half of the year. And that should, by definition, then convert into better loan growth, particularly on the retail side, better transaction flows on our credit card business and so and so on.

Q: In terms of the pockets of stress because of the tariff-exposed sectors, what is the total exposure of the bank to these sectors that might be affected? And are you already starting to build in those provisions, or are you seeing some sort of a turnaround also in sectors like microfinance institutions (MFI), micro, small & medium enterprises (MSME), which had been seeing a period of stress before?

A: We have done some work around this, particularly around our gems and jewellery business. We are quite comfortable in terms of the exposures that we are currently carrying. It is to better-rated corporates or the market leaders within that space. Second, on MFI, the general commentary is that the second half of the year will certainly be much better than where we are today, and that should play positively for us. We have a very large commercial vehicle business, and the GST cuts should play positively for that business as well.

Also Read: IndusInd Bank reports 8% decline in net advances, deposits fall 5% in Q2

Q: To close this loop on IndusInd Bank 2.0, what will be the key growth engines from hereon, and how do you get back to being among the top 3, top 4 banks? I mean, what is the pathway glide path to that?

A: One, there is work that we need to do on the liability side, such that we can bring our cost of deposits down. Two, on the asset side, we need to broaden the base of our offerings to our customers, which will, in a sense, play to the liability franchise as well, and third is to continue to strengthen some of the key businesses or domains that we have always been strong on commercial vehicles, gems and jewellery and microfinance.

Q: On the corporate side, especially given the spate of regulation reforms we have seen from the Reserve Bank of India, how much additional headroom do you think there is for credit getting unlocked, especially when it comes to capital market financing and merger and acquisition (M&A) financing?

A: I think some of the things that the RBI has done this time are seminal in that sense. Many of these things are things that the banks have been asking for, particularly M&A financing. And what RBI has put out there is truly transformational, but at the same time, it addresses the supply side. But I still worry about the amount of demand that we will have for credit, particularly from the corporate side, because they continue to be delivered, they continue to generate strong cash flow, and they have access to equity markets. And we are currently seeing 2 large IPOs in the market as we speak. Therefore, to that extent, their requirement from the banking sector at this point is expected to be relatively muted. One will have to watch out whether some of that ECB demand, etc., moves from the ECB onto local balance sheets, but still early days.

Q: Overall, you think the tone of these reforms in this regulation overhaul that we have seen from RBI, 22 announcements in one policy. What does that indicate to you, I mean, is this that the banking system is mature, and so some of these tight guard ways that the RBI had built around these systems can be let loose? Or are you worried, it could lead to some risk build-up as well if a lot of it is left to the bank’s discretion?

A: I think it clearly shows RBI’s intent to unlock the potential for the banking industry. And many of these reforms are really going to help in terms of ease of doing business, our ability to help work with our clients in a much better manner. And so, therefore, it just signals the intent of the regulator to make banking simple in this country.

Q: But you think corporate growth, which has been stalled because of the reasons you outlined as well, could get a meaningful uptick, especially with this large corporate total exposure, etc., getting revised or being scrapped altogether, rather?

A: I think those are enablers. One has to see the demand side. Just going back to your previous question on demand. I think if consumption starts to grow, it is a matter of time before private CapEx begins to kick in. And then once that starts to happen, I am sure there will be demand from corporates both on the working capital side as well as for term loans.

Q: Even on the ECL front, the expected credit loss adoption, which has been talked about for many years now, the RBI is talking about 2027 and another 5-year glide path for banks to adopt that. That gives you plenty of time to absorb any sort of additional provisioning that may be available.

A: If you look at the banking industry, various banks are at various stages of evolution as far as ECL is concerned. I think some of the larger private banks are much closer to adoption, while some of the other banks may be…and so therefore, to that extent, the fact that RBI has put out a roadmap, a glidepath for this. First and foremost, it takes the uncertainty out of…and we have been talking about when ECL is going to come for the last 4 or 5 years. So, at least to that extent, that is now out. And you will see various banks, there will be early adopters, and there will be banks that will use the full 4 years.

Also Read: CRED partners with ixigo for flight bookings on its newly launched IndusInd Bank RuPay Credit Card

Q: Speaking of capital, there is a board approval in place now for you to raise capital. How soon before we see IndusInd Bank raising equity? Take us through the timelines and the deployment of that for various purposes.

A: The resolution is just an enabling resolution. But if you look at the numbers from a capital adequacy perspective, we are well above 16%. Common Equity Tier 1 (CET1) is well above 15%. So, at this point, IndusInd Bank doesn't require capital.

Q: So, you might not be raising that capital at all.

A: I do not see us raising capital, at least in the short term.

Q: What is the next big thing to watch out for from IndusInd Bank in 2026 as you steady the ship and rebuild the bank? What is the one big theme to watch out for?

A: It is the rebuilding of trust; like I mentioned to you, everything that we do has to ensure that we once again become the trusted partner and a partner that our customers will repose faith in, the regulators are we are comfortable with our business model and the ethical standards that we are working with. Investors get comfortable in terms of disclosures, and the media is once again more favourably disposed towards IndusInd Bank.

Watch the interview in the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_chart_trending_march_jpg_ad3a86ed42.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_new_b2128e67d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Kellanova_Image_0c708f8e9a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)