Advertisement|Remove ads.

Ray Dalio Warns Borrowings Will Surge If Incomes Fail To Keep Up With Debt Growth

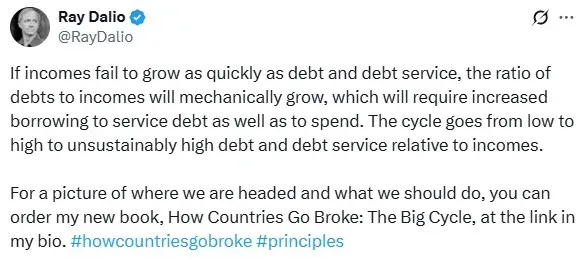

Bridgewater Associates founder Ray Dalio on Friday warned that if income growth fails to keep up with that of debt, the economy could find itself in a circular trap that goes from high to “unsustainably high debt.”

“If incomes fail to grow as quickly as debt and debt service, the ratio of debts to incomes will mechanically grow, which will require increased borrowing to service debt as well as to spend,” Dalio explained, in a post on X.

Dalio’s warning points to the slower pace of income growth. According to data from the Bureau of Economic Analysis, wages and salaries grew in the range of 3.8% to 5.6% over the past 12 months.

Meanwhile, as per the data from the Department of the Treasury, the U.S. government debt grew from $35.3 trillion in August 2024 to $36.9 trillion at the end of July, with a growth rate of 4.8%, which is higher than the mid-point of wage growth of 4.7% during this period.

Treasury data also shows the U.S. government has spent $1.02 trillion year-to-date on just meeting interest expenses–this does not include repaying the principal component of the federal debt. According to Dalio, what separates a sustainable debt cycle from an unsustainable one is whether the debt creates sufficient income to pay for the money borrowed.

Meanwhile, U.S. equities traded higher in Friday morning’s trading session. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.6%, while the Invesco QQQ Trust (QQQ) gained 0.7%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

Also See: Dan Ives Outlines 3 Moves Apple Needs To Make To Avoid A ‘BlackBerry Moment’ In AI

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)